CNBC | Jaden Urbi

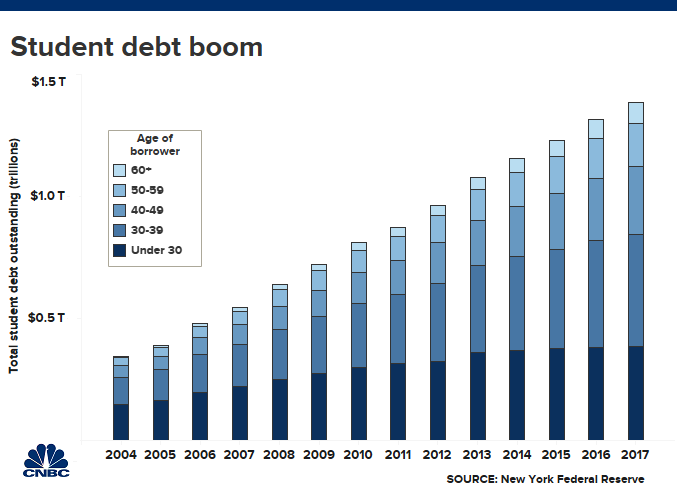

Outstanding education debt has outpaced credit card and auto debt. The average college graduate leaves school $30,000 in the red today, up from $10,000 in the 1990s.

Nearly 40% of students who took out loans in 2004 will default on their debt by 2023, according to the Education Department’s own figures released this week. Meanwhile, five years after graduation, half of borrowers are still only paying the interest on their debt.

Which proposals come to fruition remains to be seen, but one thing is clear: As discontent with the current system remains, discussions about changing it will, too, wear on.

U.S. Education Department weighs changes

Betsy DeVos, United States Secretary of Education

Michael Brochstein | SOPA Images | LightRocket | Getty Images

DeVos is proposing to spin off the $1.6 trillion federal student loan portfolio from the Education Department to its own agency. “Congress never set up the U.S. Department of Education to be a bank,” DeVos said this week at a conference of financial aid professionals.

However, Mark Kantrowitz, a student loan expert, doubts the move would solve any problems.

“Perhaps it’s seen as a first step in privatization?” Kantrowitz said.

Indeed, The Wall Street Journal reported earlier this year that the Education Department was considering selling all or portions of the outstanding portfolio to private investors.

Diane Auer Jones, principal deputy under secretary at the U.S. Education Department, recently said that the government may offer income-sharing agreements. The contracts are often framed as a potential solution to the student debt crisis, although consumer advocates have concerns about them.

Here’s how they work: Unlike a traditional loan, the recipient doesn’t pay anything back until he or she secures a job following graduation. Then the borrower is on the hook for a certain percentage of his or her income for a set period of years.

“It’s simply a disguised form of borrowing,” said Ann Larson, co-founder of The Debt Collective, an activist group.

A fresh start

U.S. Representative Alexandria Ocasio-Cortez & U.S. Senator Bernie Sanders on stage at Bernie Sanders Rally “Bernie’s Back” in Queensbridge Park. She endorses him for President of USA.

Lev Radin | LightRocket | Getty Images

Most people struggling with student loans probably didn’t imagine debt forgiveness could be in their future. Now, leading Democratic presidential candidates are calling for such a reset.

Sen. Bernie Sanders has proposed wiping out the country’s $1.6 trillion outstanding student loan tab. Essentially, all borrowers would be freed from their debt. “This is truly a revolutionary proposal,” Sanders told The Washington Post.

Under Sen. Elizabeth Warren’s plan, borrowers with household incomes of less than $100,000 would get $50,000 of their student debt forgiven. People who earn between $100,000 and $250,000 would be eligible for forgiveness on a sliding scale – that $50,000 in debt relief drops by $1 for every $3 a person earns over $100,000. And those who earn more than $250,000 would be ineligible for debt forgiveness.

A. Wayne Johnson, who used to oversee the country’s outstanding student debt and might be running for a Senate seat in Georgia, made headlines earlier this year when he proposed forgiving $50,000 in student debt for all borrowers, about $925 billion.

“It’s the first Republican support for widespread student loan forgiveness,” Kantrowitz said. “That makes it a bipartisan issue.”

Higher Education Act

Every four or five years, The Higher Education Act, which controls the shape and scope of federal student aid, is updated. It’s gone more than a decade without a tweak this round, making the changes likely to be rolled out next year highly anticipated.

House Democrats this month introduced their plan to overhaul the bill.

“I think it’s a really constructive first step toward re-authorization,” said James Kvaal, president of the Institute for College Access & Success. “There’s a lot of potential common ground in the bill, particularly around student loan issues.”

Republicans and Democrats have shown interest in reducing the number of repayment plans to just two — there are currently 14 ways to repay your student loans, a complicated system critics say leads to needless defaults.

One plan would simply spread a borrower’s monthly payments across a decade. The other would cap monthly payments at a percentage of a borrower’s income, and their repayment timeline could be 20 or more years.

There is also bipartisan support for eliminating the origination fees on student loans. “It doesn’t make sense that if you borrow $1 for college, the check is actually 99 cents,” Kvaal said.

Democrats want to cut interest rates on student loans and make it easier for borrowers to refinance their debt. They also want to allow people who’ve climbed out of default to get their credit reports cleared of the incident.

At least one Republican, in addition to a host of Democratic lawmakers and presidential candidates, wants to allow student debt to be discharged in normal bankruptcy proceedings. Currently, borrowers have to exhibit a “certainty of hopelessness” to walk away from their student debt in court.

Federal Reserve Chairman Jerome Powell has said he’s “at a loss to explain” why student loans are treated differently than other types of debt in bankruptcy.

There’s no sound reason struggling borrowers shouldn’t be able to get a fresh start, Kantrowitz said.

“Credit cards can be discharged, but not student loans?” he said.