Charles Taylor | Getty Images

There are less than four weeks left in the year, and your chances of a holiday gift at work are looking pretty good.

About 2 in 3 companies anticipate giving workers a year-end bonus or perk, according to new data from Challenger, Gray & Christmas.

The Chicago-based recruiting firm polled 250 human resources executives online from Nov. 10 through Dec. 1.

.1575490030412.png)

Truth be told, those gifts might be nothing to write home about.

Three in 10 participants said they would give workers either a monetary award of $100 or less, or a nonmonetary gift — such as a gift basket or extra vacation day.

Others might be in line for something a little more substantial. Consider that a quarter of the HR professionals polled anticipate rewarding select workers with a year-end performance bonus, Challenger found.

Wall Street employees, for instance, received an average bonus of $153,700 in 2018, according to the New York State Comptroller’s office.

Large bonuses can come with hefty taxes, so here’s how to manage.

When it pays to wait

krisanapong detraphiphat | Moment | Getty Images

For some taxpayers, pushing off the bonus into next year might be a good call.

Depending on the size of the payment, getting a bonus could bump you into an even higher income tax bracket.

“With bonuses, there’s generally some control or no control over when it’s paid,” said Robert Westley, a CPA and member of the American Institute of CPAs’ financial literacy commission.

See below for your 2019 brackets.

.1575491762157.png)

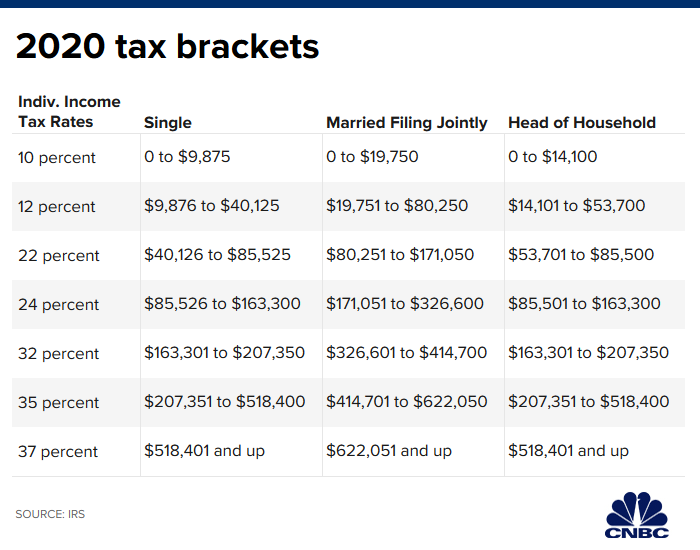

Here are your 2020 brackets.

“If there is some control, you can ask if they can pay it to you in January instead of December,” Westley said.

By deferring receipt of the money, you lower your income tax obligation for 2019.

You can also ask about spreading your bonus over multiple pay periods, he added.

Meet with your tax preparer to better gauge where your taxes stand for 2020.

Withhold more

The IRS has been banging the drum on fine-tuning the amount of income tax withheld from your pay.

Now is the time to listen.

Bonuses are taxed at a different rate than your wages.

Employers can either withhold taxes from your bonus at a flat 22% or give you the bonus with your salary and calculate the withholding based on the aggregate.

If you don’t withhold the right amount now, you could end up with a smaller refund when you file your 2019 taxes next spring. Worse, you might owe the IRS.

“The 22% might not line up with your true tax bracket,” said Westley. “So either request extra withholding at year-end or make an estimated payment to cover the shortfall.”

Be charitable

Getty Images

If you itemize on your tax return, you can boost your charitable giving and nab a deduction.

You can give directly to your favorite charity or you can contribute to a donor-advised fund — a tax-favored account that you can use to direct grants to charities.

“Bunch” multiple years’ of donations into one year to boost your deduction.

“For most people, the deductible expense they have the most control over is the charitable contribution,” said Brian Ellenbecker, senior financial planner at Robert W. Baird in Milwaukee.

Work with your financial advisor or accountant on this one, as some assets — highly appreciated stock, for instance — are more tax-efficient than cash.

Save more

designer491 | iStock | Getty Images

Reduce your taxable income by squirreling away money into your retirement savings plan.

You can save up to $19,000 in your 401(k) plan, plus $6,000 if you’re age 50 or over.

In 2020, the deferral limit goes up to $19,500, and the catch-up contribution for the 50-and-over crowd rises to $6,500.

If you’re receiving a six-figure bonus, chances are the IRS considers you a “highly compensated employee.”

These workers received more than $125,000 in pay from a business in 2019 ($130,000 in 2020), and they face limits on how much they can save in their 401(k) and other workplace benefit plans.

Consult your financial planner or tax advisor if this is the case.

More from Personal Finance:

People in this state take the longest to pay off credit cards

10 rules for gift-giving this season

Think about this before you gift that Peloton