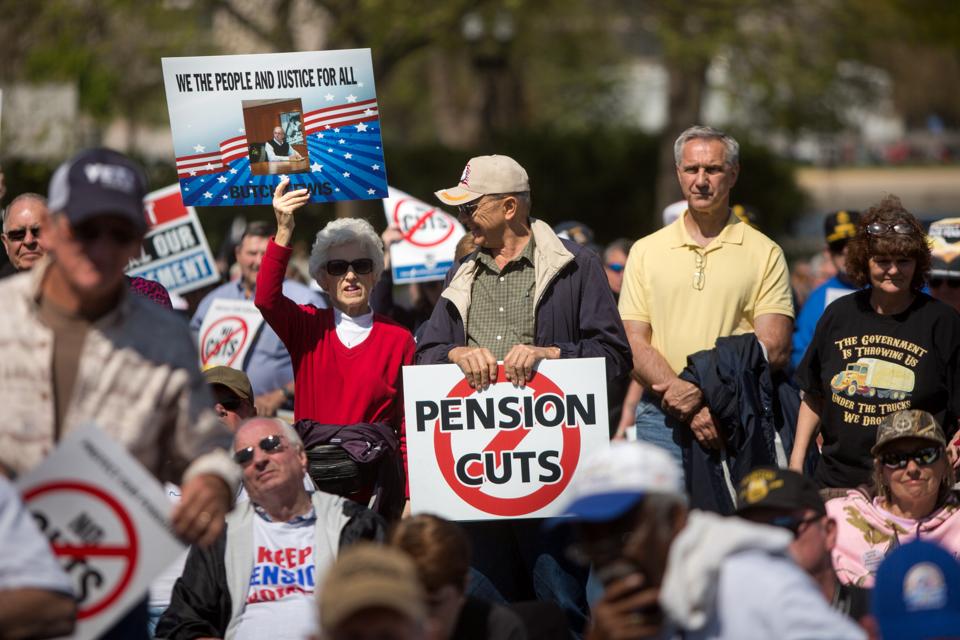

WASHINGTON, D.C. – APRIL 14: Attendees rally on the West Front of the U.S. Capitol building with … [+]

Yesterday, the AFL-CIO Retirement Security Working Group issued a statement on the multiemployer pension plan rescue proposal put forth by Senators Chuck Grassley (R-Iowa) and Lamar Alexander (R-Tenn.), which says, in part:

“The labor movement is proud of our negotiated multiemployer pension plans, which have provided retirement income security for millions of working people for decades. Now, as a result of reckless Wall Street behavior, industry deregulation and employers’ creative use of corporate bankruptcy, important parts of that multiemployer pension system are at risk. To stave off financial devastation for retirees across the nation, the Senate must act immediately—but it also must act wisely.

“Senators Grassley and Alexander have finally put forward the Republicans’ white paper to address the crisis faced by several multiemployer pension plans. As it stands, their proposal will not only injure the retirees and active participants it purports to help, it also will precipitate the collapse of all multiemployer pension plans.

“This document contains no federal financial assistance whatsoever. Contrast this to the over $700 billion that the government provided to the banks and Wall Street in 2008 and other corporate tax giveaways in recent years.”

Now, am I convinced that the Grassley/Alexander proposal is the Best Thing Ever, the most finely-crafted solution available to the pending insolvency of Central States and the multi-employer PBGC fund? No, of course not. I don’t have sufficient information about the complete mechanics of the proposal, nor the data at hand to truly assess whether the proposal does what it says it will do, and keep multiemployer plans financially healthy in the short and long term, without an unmanageable burden on participating employers.

But it is simply incorrect to assert that the proposal lacks federal financial assistance.

In the White Paper presentation of the proposal, the Senators write that one component of the entire mix of changes would be the

“transfer of a limited amount of federal taxpayer funds to PBGC,”

and the Technical Explanation specifies that the

“PBGC will provide financial assistance to the Successor Plan equal to the amount needed to pay monthly benefits to participants and beneficiaries in the Successor Plan up to the PBGC guarantee level (as increased by this proposal).”

How much money is at stake here? How does the additional premium revenue, the “copays” (benefit cuts), and the federal financial assistance all play out in terms of actual concrete numbers. Those numbers haven’t been released yet. I’m told by a congressional staff assistant with knowledge of the discussions that those numbers are simply still being crunched by the relevant number-crunchers.

But for the AFL-CIO to pin the failings of the multiemployer pension system wholly on nefarious bogeymen such as Wall Street and scheming employers, is simply wrong, as is their insistence on a Butch Lewis-style bill, that is, a promise that the pending insolvencies can be resolved without any benefit cuts.

Are they hoping for better terms by proclaiming this bill DOA? Is there something more going on behind the scenes? Time will tell, I suppose, but a little honesty — or reading comprehension — would have been a nice start.

What do you think? Share your thoughts at JaneTheActuary.com!