The most common question I receive about college savings is, “What happens if my kid doesn’t go to college?” There are two reasons families ask this question:

- They are worried about locking money into college savings that will never be used or or that they’ll be penalized for non-qualified withdrawals.

- They want an excuse to not do anything. Doing nothing is easy, and it takes a little effort to find, open, fund, and administer a higher education savings account.

When it comes to college it is always better to save than borrow. Most investors will benefit from a tax-advantaged CSA (College Savings Account) such as a 529 plan or Coverdell ESA (Education Savings Account). Families in higher tax brackets get a greater tax-deferral benefit from CSAs, but there are many additional state benefits for low-income savers – like state tax benefits, grants, and matching programs for 529 contributions – that are exclusive to lower income brackets (check with your state).

Not every child goes to college. So what happens to your college savings?

Savers Are More Likely To Go To College

Families that prioritize a higher education financially also create an expectation of attendance with their children. The question isn’t, “if” they’ll go to college, but “when.”

Children of low- and moderate-income families that save for college are three times more likely to attend college and four times more likely to graduate than non-savers (source). Having as little as $500 set aside has a dramatic impact on the probability that family members will attend.

If You Child Does Not Attend Or Drops-Out Of College

While withdrawals for qualified higher education expenses like tuition are tax-free, both 529s and Coverdell ESAs impose a 10% penalty tax on earnings for non-qualified distributions. For example, if you withdraw money for tuition you pay no federal or state tax. However, if you buy a speedboat, you’ll pay tax on earnings plus a 10% penalty tax.

Still, you shouldn’t let the potential penalty discourage you: Even if your child doesn’t attend college or drops out you have options. Plus, as you’ll see shortly, you may earn more through a CSA – even with the penalty – than you would have otherwise.

- Change The Beneficiary – Even if the original account beneficiary does not go to college or drops out, another member of the family can benefit from your savings. You can change that beneficiary of a 529 savings plan or Coverdell ESA without penalty so long as the new beneficiary is a member of the family of the original beneficiary, as defined by the IRS. This includes the parent. Note, however, that while a 529 plan has no age-restrictions, a Coverdell ESA beneficiary change must be initiated before the beneficiary turns 30 to another beneficiary under 30, otherwise the account must be liquidated and funds disbursed.

- Invest Longer – 529 plans never expire. This means the account owner can let funds sit in the 529 account indefinitely, allowing its investments to grow tax-deferred in perpetuity, to be used for another child or grandchild. With sufficient time you will earn more – even after taxes and penalties – than you would in an equivalent taxable account. As mentioned above, Coverdells are limited by the age of the beneficiary.

Tax-Deferred Savings Is ALWAYS Better, Eventually

If you invest in the same security – be it a mutual fund, stock, bond, or other investment – inside a tax-deferred account, it will make more money than it will in a taxable account. This is why 401(k)s, IRAs, and other tax-preferred retirement vehicles are so popular, and the same holds true for tax-deferred college savings accounts.

The question is whether it is still worth investing in a college savings account given the 10% penalty tax on earnings if you make a non-qualified withdrawal. The answer is that, eventually, every investor in every tax bracket stands to earn more inside a 529 plan or Coverdell ESA than they would outside the account, assuming they are investing in the same security.

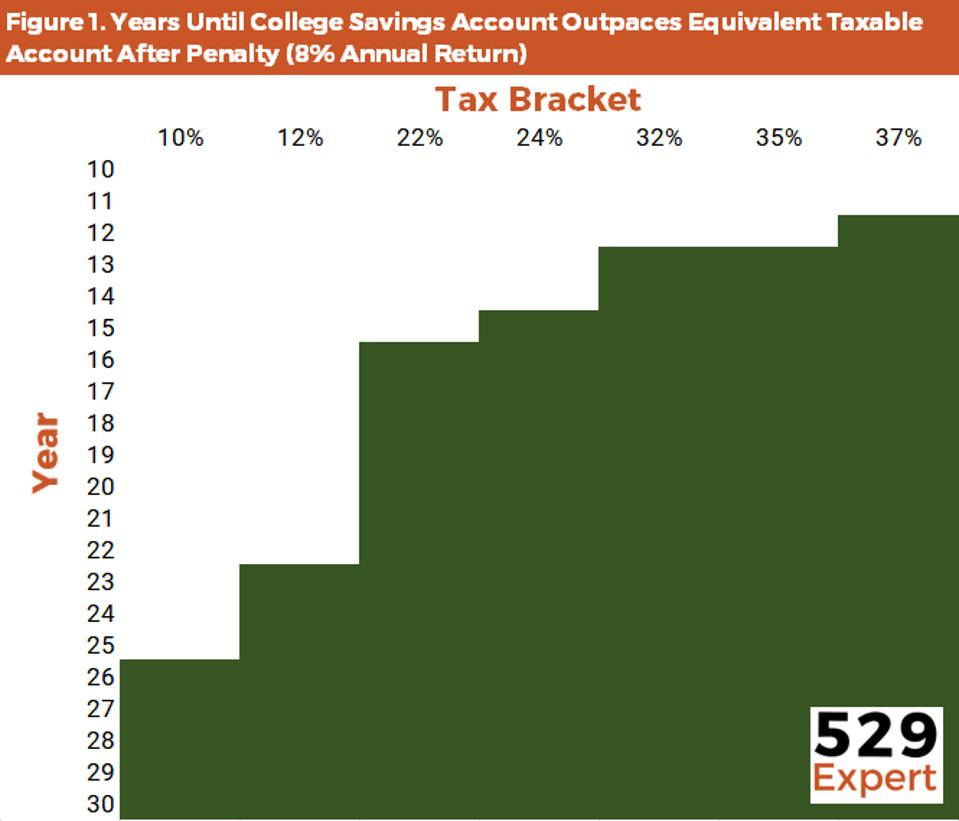

How long that takes depends on your tax bracket and how well the investments perform. The higher your tax bracket and better the investment returns, the shorter the time required to outpace the taxable equivalent after penalty. The following calculations do not take into account state tax benefits, grant programs, or other unique state-sponsored factors, and do not account for variations in fees or expenses between tax-preferred accounts and taxable accounts.

FORBES – Tax-Preferred Returns Outpace Equivalent Taxable Accounts Even With Penalty Given Enough … [+]

Assuming a historical average return of 8% annually would result in any investor earning more in a tax-advantaged college savings account, even after penalty, in 26 years. For those in a 22% tax bracket or higher that time is shortened to 16 years. Even assuming relatively weak performance of 4% annually over 29 years a tax-deferred account will still outperform an equivalent taxable investment for those in a tax bracket of 22% or higher, even with the penalty. And the longer the time horizon the greater that return. In fact, over 50 years those in the highest tax bracket would earn 23% more at a 4% annual return and 122% more at an 8% annual return rate in a tax-deferred CSA than in an equivalent taxable account.

No matter what tax bracket you are in eventually, assuming a positive return and equivalent investments, you are better off in a tax-advantaged account than not. This is especially true the longer your time horizon. State benefits available to college savers may modify these results, as well. For example, North Dakota has a matching grant program for residents with less than $120,000 in annual income (if married filing jointly). Maine has a program not limited by income bracket.

Keep in mind also that every state has unique rules and may “claw back” tax benefits taken in future years if the withdrawals are nonqualified. These rules were put in place to prevent abuse of higher education savings accounts as tax shelters.

College Savings Accounts Are Not Tax Shelters

Tax-advantaged college savings accounts were created to encourage Americans to save for a higher education. While a sufficiently long enough time horizon will yield superior after-tax returns to an equivalent taxable account, there are enough restrictions and drawbacks that investors should really only consider CSAs with the primary goal of using the proceeds for higher education. These hypothetical returns are to reassure investors that, in the unlikely event their beneficiary does not attend or drops out of college, a tax-advantaged higher education account could still turn out well for them.

Sources