alphaspirit | Getty Images

For 137 million Americans, they can be the scariest bills to open.

That’s the number of adults who have faced medical financial hardship in the past year, research shows.

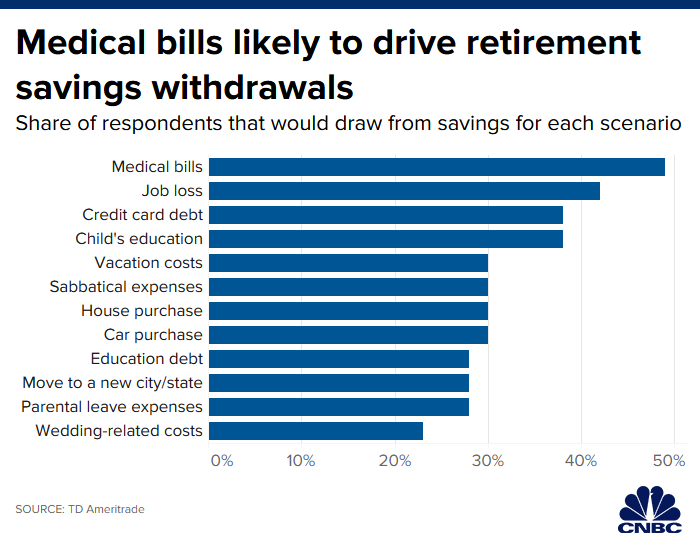

In fact, medical debt is the top reason that people, regardless of age, would consider cashing in their 401(k)s or other retirement savings, TD Ameritrade found.

And even then, raiding their long-term savings is often not enough. Separate research published this year found that 66.5% of all personal bankruptcies are tied to medical issues.

It’s a problem that Bliss Butler knows all too well.

Butler, 59, who lives just outside of Oklahoma City, lost her job at an area museum in 2013. Because it was difficult to make her COBRA medical continuation payments, she ended up uninsured.

Bliss Butler, pictured with her boyfriend, has struggled with high medical bills after several unexpected health emergencies.

Then several health crises cropped up. First, Butler had a kidney stone, which required a trip to the emergency room and a hospital stay, as well as a follow-up visit to a surgery center to remove a stent.

Then, she broke her leg. Because she was still in debt from her previous medical bills, she avoided taking an ambulance. She had to have surgery and that came with a hefty bill for about $60,000.

Another health scare, when Butler experienced heart palpitations, sent her to the ER again.

Today, Butler admits she doesn’t know the full tally of her medical debts. Separate invoices appear with alarming numbers such as $36,860.75 and $19,881.58.

Weekly advice on managing your money

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

It’s difficult to understand what they are specifically billing her for, Butler said, not to mention how much she really owes.

Butler said she has already spent all of the $20,000 she had accumulated in her retirement savings.

“I’ve never been on any kind of public assistance,” she said. “I’ve never been on Medicaid.

“I’ve always worked for a living.”

Now, her next step is likely filing for bankruptcy. That’s after years of working, being careful with her money and largely avoiding accumulating other debts.

“I don’t think that my particular story is that unusual,” Butler said. “There are so many people that are in the same position that I am.”

Know your rights

A lack of transparency when it comes to medical billing has inspired Dr. Marty Makary, professor of health policy and management at Johns Hopkins Bloomberg School of Public Health and a surgeon at Johns Hopkins Hospital, to work to change the system.

Dr. Marty Makary, surgeon at Johns Hopkins Hospital and professor of health policy and management at the Johns Hopkins Bloomberg School of Public Health.

That has included representing patients pro bono in court when hospitals sue them over unpaid bills.

“We have an irrational marketplace where price gouging has become an accepted way of doing business,” said Makary, who is author of the book, “The Price We Pay: What Broke American Health Care — and How to Fix It.”

What many consumers don’t realize is that it’s possible to shop around on price when it comes to the care they receive, Makary said.

Costs can vary widely, from $44,000 for heart surgery at one hospital to $500,000 for the same procedure at another. And research has shown that that disparity does not reflect a difference in the quality of care, Makary said.

Websites like MDSave.com and Sesame.com allow consumers to compare prices, he said.

Even in an emergency situation where you need care immediately, you can take steps to protect yourself financially, he said.

We have an irrational marketplace where price gouging has become an accepted way of doing business.

Marty Makary

professor and surgeon, Johns Hopkins

Many medical providers have you sign both health-care and financial consent forms. However, you don’t necessarily have to agree to both. “If you don’t feel comfortable signing the form, you can put that in the signature line,” Makary said.

You can choose to write, “I don’t feel comfortable signing my life away financially” or “Did not read” on the signature line, he said.

Negotiate your debts

In the event that you are already saddled with hefty bills, there are still steps you can take to try to alleviate your burden.

Most bills are negotiable before, during and after care, Makary said.

Negotiating is the first step that Dr. Carolyn McClanahan, founder and director of financial planning at advisory firm Life Planning Partners in Jacksonville, Florida, tells people to pursue.

Make sure everything on the bill is correct, McClanahan said, and that you actually received all the services they’re billing you for.

More from Personal Finance:

This is the real reason most Americans file for bankruptcy

Here’s how to keep health-care costs down in retirement

Relying on Medicare with no backup insurance might be a costly mistake

If you still can’t afford to pay, check to see if the hospital or medical organization provides charity services and whether you qualify for forgiveness, she said.

If that doesn’t work, ask if they will let you set up a payment plan. Some hospitals will be OK with low payments, as long as you’re making progress toward the debt, McClanahan said. Plus, they may not charge you interest.

After that, you may think of borrowing against a credit card, home equity line of credit or your 401(k). The key is to compare which offers the best interest rates, McClanahan said, and to be aware of the risks.

“There’s always danger in borrowing against a 401(k),” McClanahan said.

One reason for that is if you leave or lose your job, that balance on the loan is due immediately, she said.

Plus, if you’re under 59½, you will face a 10% penalty for early withdrawals.

There is an exception to that rule. If your medical bills are more than 7.5% of your adjusted gross income, you do not have to pay that 10% penalty, said Molly Passantino, senior specialist of retirement and annuities at TD Ameritrade.

Still, you will lose the opportunity to let your money continue to grow. “We really stress that you should keep money in your retirement account for as long as possible,” Passantino said.

Admittedly, many individuals have no choice when faced with high medical bills. That is something Makary is pressing the medical industry to change.

“When somebody gets treated, it they experience financial ruin, that is part of the experience,” Makary said. “That is part of how we should evaluate, ‘Did we take care of this person when they came to us vulnerable and sick?'”