Getty

The Centers for Medicare & Medicaid Services has announced Medicare Part B premiums for 2020, and the base premium increases nearly 7% from $135.50 a month to $144.60 a month. That $9.10 monthly increase compares to a modest $1.50 monthly increase last year. Meanwhile high earners are still getting used to income-related surcharges that kicked into higher gear in 2018, and those have been bumped up again too. The wealthiest senior couples will be paying nearly $12,000 a year in Medicare Part B premiums. Part B (the base and the surcharge) covers doctors’ and outpatient services.

The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. What’s to blame for the bigger increases this year? Rising spending on physician-administered drugs, according to CMS.

The CMS announcement comes after last month’s Social Security Administration’s COLA announcement: a 1.6% cost of living adjustment for 2020. The average Social Security benefit for a retired worker will rise by $24 a month to $1,503 in 2020. The higher Medicare Part B premium cuts into retirees’ monthly Social Security payments. Part B premiums typically are deducted from monthly Social Security checks).

While most Medicare recipients will pay the new $144.60 standard monthly premium, some will pay less because of a “hold harmless” provision that limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

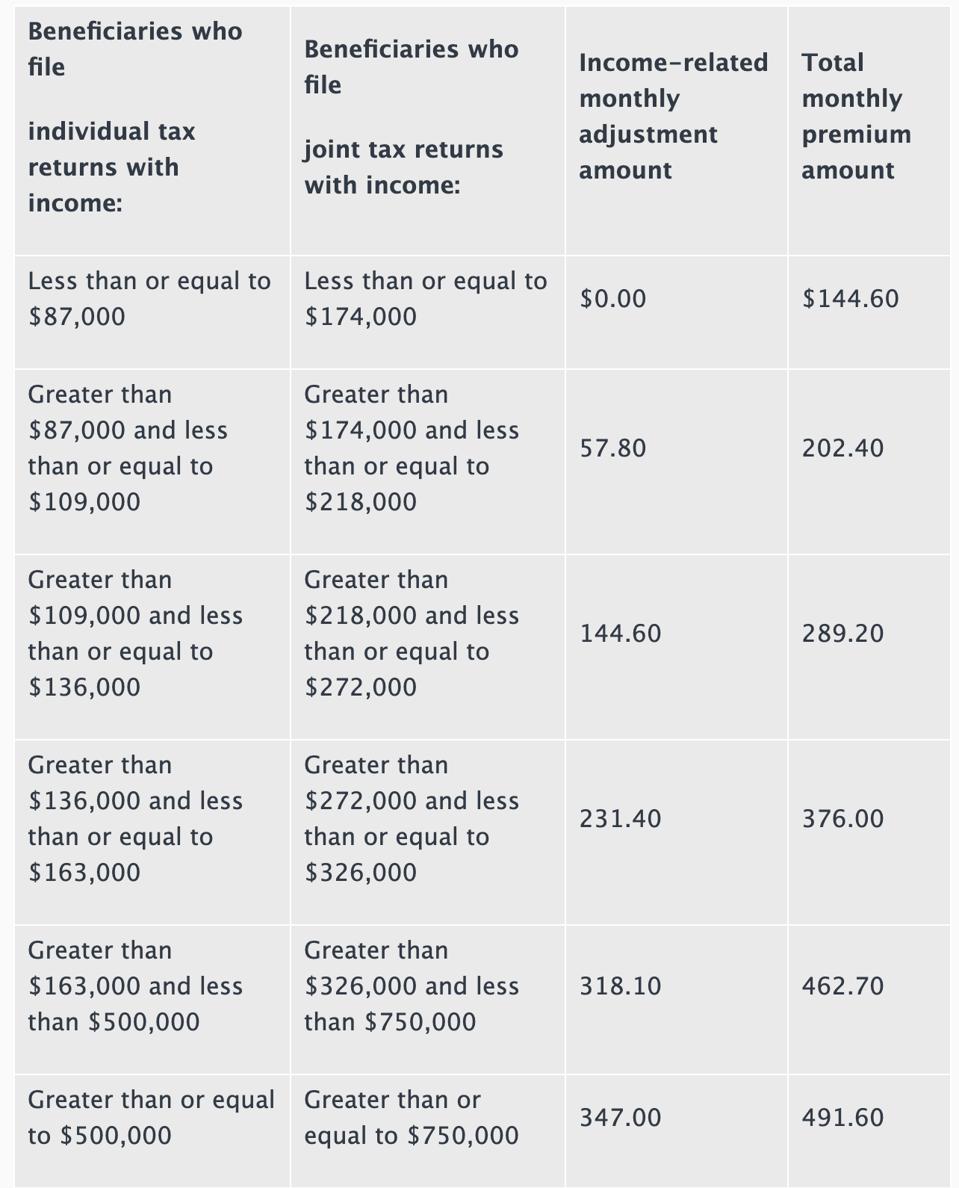

This year CMS says 7% of Medicare recipients, up from 5% this year, will have to pay income-related surcharges. The graduated surcharges for high-income seniors kick in for singles with modified adjusted gross income of more than $87,000 and for couples with a MAGI of more than $174,000. An individual earning more than $87,000, but less than or equal to $109,000, will pay $202.40 in total a month for Part B premiums in 2020, including a $57.80 surcharge. That’s up 9% from 2019: $189.60 total in a month, including a $54.10 surcharge.

By comparison, the wealthiest retirees – singles with $500,000 of income and couples with $750,000 of income – will face total premiums of $491.60 a month, including a $144.60 surcharge, in 2020 ($11,798.40 a year). The 2019 numbers are here.

The income-related premium surcharges apply to Part D premiums for drug coverage too.

Here are the official numbers from the CMS release, what you’ll pay per month for 2020, depending on your income, for individuals and couples filing a joint tax return (the 2020 income-related surcharges are based on AGI reported on 2018 tax returns):

CMS