Advertising billboards seen in Times Square, New York City

Brigitte Blättler | Moment | Getty Images

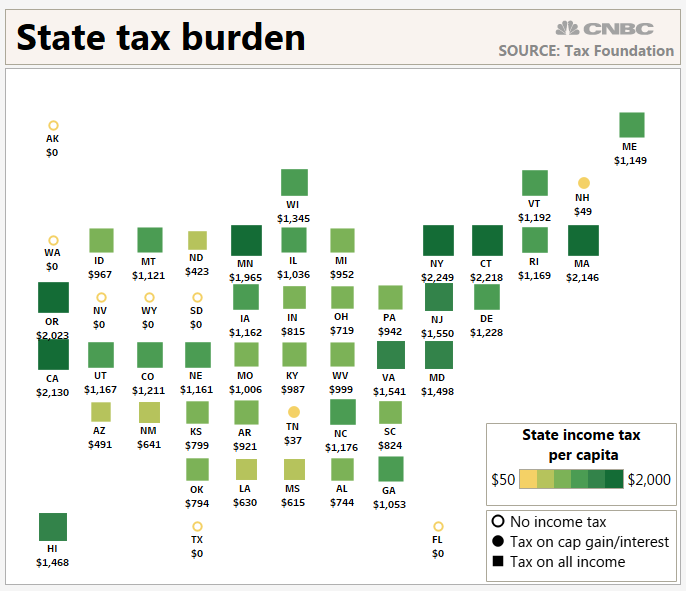

If you’re living in the northeastern part of the country, chances are that you’re paying some hefty income taxes.

New Yorkers paid the most in state income levies — $2,249 per capita during the 2017 fiscal year, according to the Tax Foundation.

Connecticut followed in second place with $2,218, while Massachusetts came in third with $2,146.

In all, seven states don’t tax individual income: Alaska, Florida, Nevada, South Dakota, Texas, Washington state and Wyoming.

Residents in Tennessee and New Hampshire don’t face taxes on wages, but income from interest and dividends is subject to a levy.

Contributing to coffers

Don’t leave New York for Florida — a strategy recently employed by President Donald Trump — just yet.

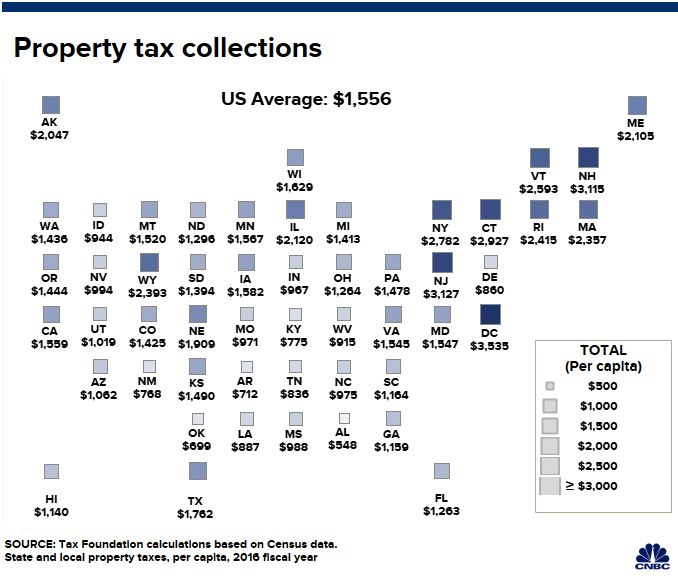

Any state that doesn’t take its share of income levies often will find that revenue elsewhere.

For instance, Nevada and Florida have sales taxes and levies on lodging to help fill their coffers.

Property taxes are another significant tax. Consider that while New Hampshire won’t assess your wages with an income tax, the state and local property tax per capita is $3,115, the Tax Foundation found.

Cities may also apply their own levies. “Local taxes can really depend on whether you live in an urban environment versus rural,” said Katherine Loughead, policy analyst at the foundation.

Fewer write-offs

FreezeFrameStudio | E+ | Getty Images

The Tax Cuts and Jobs Act of 2017 put in place new limitations on the extent to which taxpayers who itemized their returns could write off their state and local taxes.

Starting in 2018, you can only deduct up to $10,000 of these state and local levies on your federal return.

Taxpayers who took this so-called SALT deduction in New York claimed an average of $21,779 in 2016, according to the Tax Policy Center.

The new law also doubled the standard deduction, which creates a higher hurdle for taxpayers who want to itemize.

More from Personal Finance:

What it takes to get into a top college

How much you can save toward retirement in 2020

3 cities where homeowners get the highest rates of return

In 2020, the new standard deduction for individuals will be $12,400 ($24,800 for married filing jointly and $18,650 for head of household).

Indeed, fewer people deducted state local income or general sales taxes during the 2018 tax year. About 14 million returns for that year claimed this break, according to IRS data through July 25.

Meanwhile, more than 40 million returns claimed the SALT deduction for the 2017 tax year, according to IRS data from the comparable year-ago period.