Income investors have been crushed this year. Bond yields are down and stocks pay less and less “dividend per dollar” with each rally. But there’s still one little-known corner of the investing world we can look to for safe yields up to 11.8%.

Business development companies (BDC) provide debt and equity financing for small and midsize businesses. Banks, in recent decades, have deemed these types of lenders “too risky.” So, BDCs put on their big boy risk-evaluating pants and began to provide some powerful payouts that are backed by the cash flows of the firms they lend to.

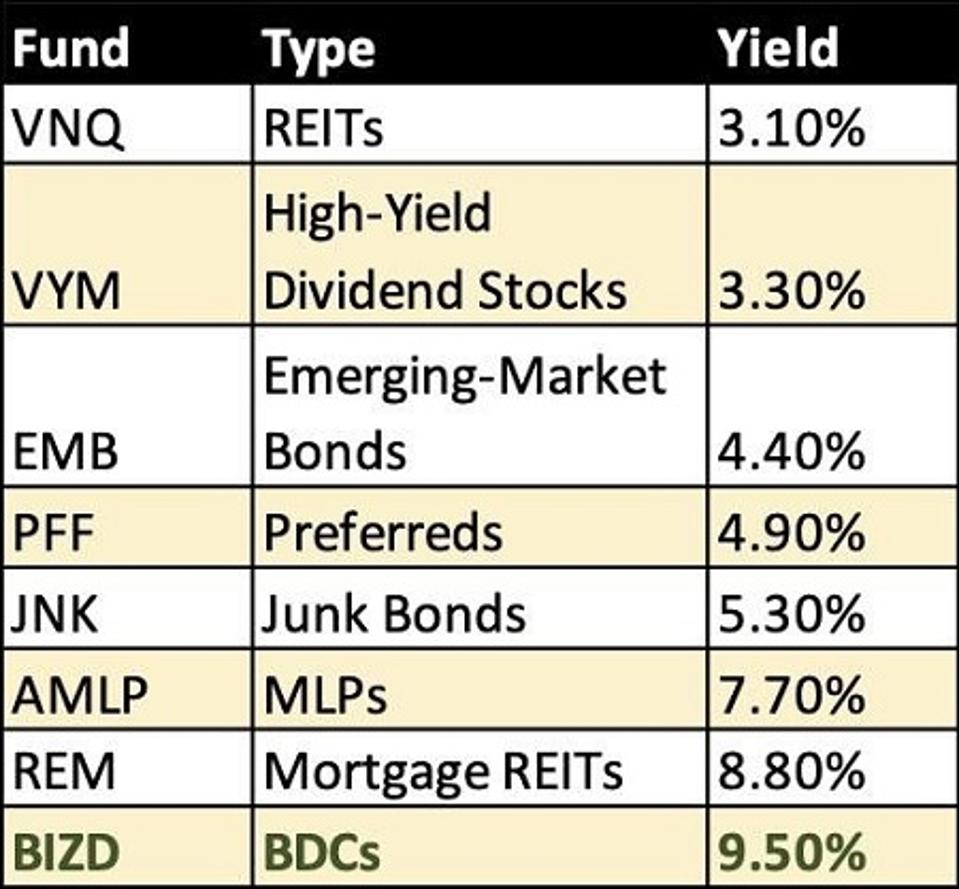

Double-digit yields are the norm, not the exception, in this extremely niche area of the market. Indeed, BDCs currently offer yields almost twice as high as high-yield bonds and triple what you’re getting from real estate investment trusts (REITs) at the moment.

BDCs’ high-yield stature isn’t anything new. These companies, just like REITs, are required to pay out 90% or more of their taxable income as dividends, so their businesses are income gushers by their very nature.

But the gap between BDC yields and other areas of the market has been widening over the past couple years as popular competing payouts get pancaked!

Sounds great, but what’s the catch? Not all BDCs are created equal. Some are mere “paper payout tigers.” Sure, they pay their dividends–but they take the distributions out of their own net asset values (NAVs), which means their stock prices give back most (or all) of the payout. Which is pointless.

Here’s what I mean. The VanEck Vectors BDC Income ETF (BIZD) is up 15% so far in 2019, but it’s still deeply underwater across the past half-decade. This industry has too many issues to count: increased competition over the past few years, high costs from external managers, even fears of an incoming recession (which would wreak havoc on the smaller businesses they finance.)

There are so many weak links in the BDC industry that I wouldn’t play the sector with a diversified fund. The few winners in the space get drowned out by a sea of losers. So today, I want to dig into three individual BDCs, boasting mammoth yields of 7.5 to 11.8%, to show you both the hazards and the high-quality high yields in this space.

PennantPark Investment (PNNT)

Dividend Yield: 11.8%

PennantPark Investment (PNNT) isn’t exactly lacking for experience, boasting $10 billion in capital deployed over its lifetime and more than 180 partnerships with private-equity sponsors.

(Quick side note: The beauty of BDCs is that they’re virtually private equity companies themselves. They allow you and me to invest in privately held small businesses, but without traditional PE’s $1 million-plus minimum buy-ins.)

PennantPark provides exposure (typically through first- and second-lien debt) to companies that are owned by “established middle market private equity sponsors with a track record of supporting their portfolio companies,” and that typically generate between $10 million and $50 million of EBITDA. Portfolio companies at the moment include the likes of primary-care clinic operator Cano Health, marketing services firm Phoenix and glass-product fabricator American Insulated Glass.

Despite its focus on PE support, as well as a fairly diversified portfolio, PNNT has been skidding for years. Here’s a look at its net investment income (NII, an important profitability metric for BDCs) from the past four years:

- 2015: $1.10 per share

- 2016: $0.99 per share

- 2017: $0.79 per share

- 2018: $0.75 per share

The company is on pace for yet another disappointment, with 51 cents per share in NII through the first nine months of its fiscal year, down from 55 cents at the same point in 2018. That’s bad on its face, but even worse when you consider that the company has paid out 54 cents per share in dividends so far in 2019.

That doesn’t add up.

A sharp drop in NAV earlier this year has stoked more investor fear in PNNT. So has the Fed yanking the brake on interest rates, which doesn’t help PennantPark’s predominantly floating-rate debt investments. Let’s move on.

TPG Specialty Lending (TSLX)

Dividend Yield: 7.5%

TPG Specialty Lending (TSLX) is a higher-quality BDC that I highlighted earlier this year, and that has gone on to beat the broader BDC funds since then in an erratic year for the industry.

A quick refresher:

TPG Specialty Lending is the direct credit investment platform of private equity outfit TPG. If a small business needs money to gobble up a complementary company, restructure itself or just fund growth, TPG Specialty Lending likely has a solution. The “typical” portfolio company varies widely, with the company investing anywhere from $15 million to $350 million in companies with an enterprise value of between $50 million and $1 billion.

In short, TSLX doesn’t shy away from much.

The result is an interesting portfolio mix. You get access to lesser-known businesses such as risk-management software provider Riskonnect, oil-and-gas E&P firm Mississippi Resources, and cloud treasury/finance leader Kyriba. But you’re also plugged into investments in companies with more name recognition, such as smarthome-services provider Vivint, retailer Barneys New York and grocer Save A Lot.

TSLX is dealing with shrinking net investment income this year, too, and it’s no small drop. Its $57.8 million in NII through the first six months of its fiscal year is down 14% from this time last year. That said, the BDC is carrying a heftier heap of unrealized gains. As a result, its six-month net income of $1.32 per share is actually 23% higher year-over-year.

TPG Specialty Lending continues to intelligently live within its means, too. TSLX has stuck with a base dividend rate of 39 cents per share for years. However, since 2017, it has paid out quarterly special dividends as additional profits allowed. Based on special dividends over the past 12 months, TSLX actually yields 8.6% – more than a percentage point higher than its headline yield.

Newtek Business Services (NEWT)

Dividend Yield: 10.0%

I highlighted the virtues of Newtek Business Services (NEWT) two years ago, and given what it has accomplished since then, it’s worth a fresh look.

Newtek is a direct business lender that caters to businesses of all sizes, and I really do mean all sizes. Its lines of credit start at just $10,000, and extend all the way up to $1.5 million.

The first thing that struck me when I reviewed it back in 2017 was, of all things, its website. It’s glossy. It’s consumer-facing. As I said at the time, it “looks more like a commercial banking portal than a dry BDC.”

“But Newtek doesn’t just feel different — it is different.”

Indeed, if Newtek were just a direct business lender, it probably would be in the same leaky boat as many other BDCs. But NEWT isn’t just that, and instead has positioned itself as something of a full-service depot, helping portfolio companies with mobile payment processing solutions, web design, even payroll and benefits.

Many of its services are critical to small businesses — things they would seek out on their own anyway. Newtek, by offering these services itself, is proactively improving the chances its investments pay off.

Investors should know, however, that Newtek doesn’t have a fixed dividend. While the overall trend is friendly, the BDC does have a variable payout. Yes, NEWT is dripping in dividends at the moment, but it’s hard to rely on it for consistent retirement income.

The upside is that Newtek’s adjusted net investment income (ANII) is growing like a weed, and that in turn is helping it to pay its rapidly expanding dividend. ANII for the first six months of 2019 are up 15% year-over-year, and the company expects its full-year payout will be 19% greater than 2018’s.

In short, Newtek continues to be a bright spot in a difficult industry.

Brett Owens is chief investment strategist for Contrarian Outlook. For more great income ideas, click here for his latest report How To Live Off $500,000 Forever: 9 Diversified Plays For 7%+ Income.

Disclosure: none