People drink beer on a patio before the arrival of Tropical Storm Dorian in Boqueron, Puerto Rico, … [+]

For most people in the U.S., it’s easy to forget Puerto Rico outside of the occasional still-in-trouble-after-hurricanes story you’ll see. But the picture is much worse than even that. The economy is broken and in freefall.

The U.S. Bureau of Economic Analysis—the government organization that generates important statistics—has begun the basic work to create a GDP analysis of the island. A place, although a territory of the U.S., outside of the zone of constitutional rights, so any guarantee of protections depends on laws passed in Congress that can be undone. A place where a complicated financial history led to systemic fiscal instability and weakness that combined with banks pushing toxic and dangerous borrowing deals for a government desperate to get out of a financial jam. The buyers of the bonds that came from the borrowing? Citizens of Puerto Rico.

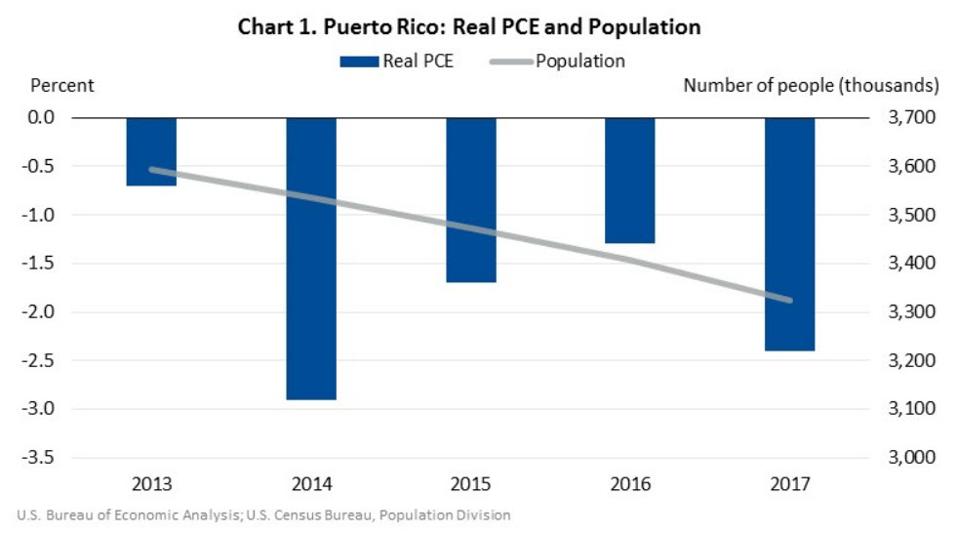

The U.S. has done much to undo the economy of Puerto Rico, as the BEA figures show. Looking at the period from 2012 to 2017, the picture is grim. Think of the pain of a recession. Now project that to continue for at least half a decade. Below is a BEA graph showing years of loss, of both personal consumption expenditures (PCE)—consumer spending, which for the U.S. as a whole is roughly 68% of GDP—and population. From 2012 through 2017, the average annual PCE change was -1.8%.

Annual personal consumption expenditures and population in Puerto Rico.

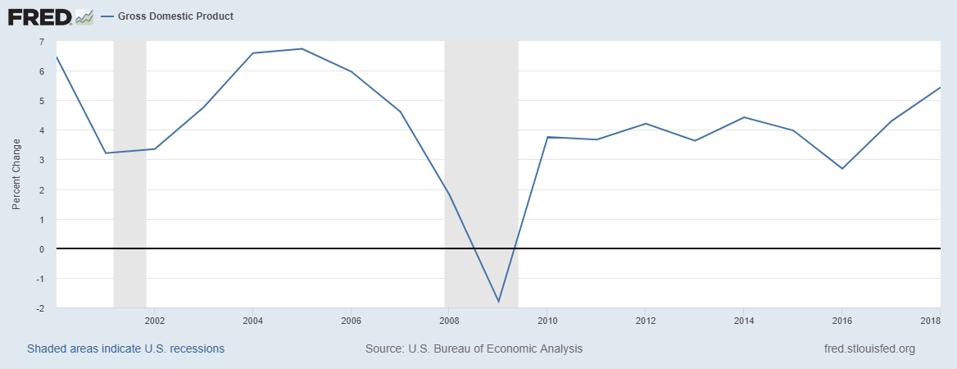

To put this into perspective, here is a graph from the Federal Reserve Bank of St. Louis, using BEA data, that shows the year-over-year change in U.S. GDP. Notice the broad gray band in the graph’s center, which covers the Great Recession. At its lowest point in 2009, the annual GDP drop was just under 1.8% and that was with massive injections of government spending included.

Annual change in U.S. GDP

Puerto Rico’s consumer spending saw nearly that much drop on average during the 2012-2017 period. It seems unlikely that there was a sudden and massive reversal in 2018 or this year.

A good part of the drop is the loss of population. From 2012 to 2013, 1.1% of the population left. The year-over-year drop in 2014 was 1.6%. Then 1.7% in 2015, 1.9% in 2016, and 2.5% in 2017. PCE dropped by 0.7% between 2012 and 2013, and then, year over year, by 2.9% in 2014, 1.7% in 2015, 1.3% in 2016, and 2.4% in 2017.

Private fixed investment, another GDP component, fluctuated. Between 2012 and 2013 it was down by 1.7%, roughly flat in 2014 and 2015, down another 1.8% in 2016, and up by 0.4% in 2017.

A third component of GDP is net exports. Puerto Rico does have a net surplus in exports over imports, but about 43% of exported goods were pharmaceuticals and organic chemicals. Those are products of companies from the U.S. that obtain favorable tax status for having facilities there while maintaining access to a U.S. transportation advantage. Puerto Rico is a point of convenience and the bulk of the money goes elsewhere.

GDP in Puerto Rico is down because of a vicious circle further spurred on by Hurricanes Irma and Maria. When economies fail, people leave for jobs and to make money they can send home to their families. That causes more collapse of the economy, driving additional people away. The dual hurricanes exacerbated the situation, but the problems already existed. Talk of emergency aid and how much Puerto Rico should be given only touches on the additional physical collapse. None of that would address the ongoing need for an economic jumpstart of the area.

If we really want to address the problems in Puerto Rico, first we must see them. The economic picture has been terrible for a long time. Fixing it does require a lot of rebuilding, but also an acknowledgement of what this country has done, from policies to turn the island into a tax haven to the restriction of movement of goods by the Jones Act, driving up the cost of imported products. We have through an organized series of steps devastated the land for our convenience. It’s time we recognize our collective culpability and set the situation right.