Martin Barraud | Getty Images

It’s the time of year for people on Medicare to give their coverage a checkup.

The program’s annual enrollment period runs from Oct. 15 through Dec. 7, which is when you can make changes to your coverage that will take effect Jan. 1. During this window, you can:

• Switch to an Advantage Plan from original Medicare (Part A hospital coverage and Part B outpatient care);

• Switch to original Medicare from an Advantage Plan;

• Move from one Advantage Plan to another;

• Move from one prescription drug plan (Part D) to another, or purchase one if you did not when first eligible.

Experts say that even if you’ve been happy with your 2019 coverage, both Advantage and prescription drug plans are modified from year to year — and new plans become available, as well — which means it’s important to evaluate whether your current option is still the best available for you.

“Each insurance carrier revisits their [drug] formulary and they renegotiate provider contracts,” said Elizabeth Gavino, founder of Lewin & Gavino in New York and an independent broker and general agent for Medicare plans. “So you need to make sure your providers, prescriptions and your preferred pharmacy are still on the plan.”

Additionally, changes can affect your premiums, copays, deductibles and covered services, along with the cost of your prescriptions. And, you might find coverage that meets your needs at a better cost.

If, after evaluating your options, you determine that you want to stick with your current coverage, you don’t need to take any action.

It’s worth noting that Medicare’s fall open enrollment is different from your initial enrollment period, which is a seven-month window that starts three months before your 65th birthday and ends three months after your birth month.

Also during that initial sign-up time, you can sign up for an Advantage Plan, which includes Parts A and B and, typically, a Part D prescription plan. These plans also often include additional coverage such as dental, vision or wellness programs.

Here are some key things to keep in mind this year.

What’s new

If you use the Plan Finder tool on Medicare.gov to compare your options each year, you’ll be navigating a new system.

The updated version, which became available to users in late August, was met with criticism due to various changes — and glitches — that caused incomplete or incorrect results to be generated. While the Centers for Medicare and Medicaid Services has deployed many fixes in the wake of the negative feedback, it’s uncertain whether more tweaks are in store or if users will continue running into issues.

“The intentions were good, but the timing was terrible,” said Danielle Roberts, co-founder of insurance firm Boomer Benefits in Fort Worth, Texas.

She added, though, that users can always call 1-800-MEDICARE if any information seems to be missing or anything is unclear.

As of Tuesday, there were still differences between the new and old versions that were not viewed as improvements. For example, users were still finding incomplete results related to prescription drugs, including the details of a particular plan’s limits on the quantity of the medicine you need covered.

Meanwhile, you also might notice some supplemental benefits available through Advantage Plans that you hadn’t seen in the past.

While many plans already offer extras such as dental or vision coverage, new rules allow Advantage Plans to offer services that go beyond traditional medical care. For example, roughly 500 plans are expected to offer services such as adult day care or caregiver support systems next year, according to the Centers for Medicare and Medicaid Services. Another 250 plans will offer things such as meal delivery, rides to the grocery store or even pest control.

However, not all extra benefits are available to everyone who enrolls in the particular plan offering them. Some may only be extended to people with certain chronic illnesses or conditions — and even then, whether you qualify must be assessed by the plan once you’re enrolled.

“You won’t know if you’re eligible for those supplemental benefits until you’re in the plan,” said David Lipschutz, associate director for the Center for Medicare Advocacy. “So don’t be lured in only by the bells and whistles.”

More from Personal Finance:

The Number 1 reason why seniors work well into retirement

How to know if a pension lump sum is right for you

Earning income after 65? How to make it work for you

If you pick an Advantage Plan during fall enrollment and realize afterward that it’s not a good fit, you can change your coverage between Jan. 1 and March 31 by switching to either another Advantage Plan or to original Medicare and a stand-alone prescription plan.

Be aware that while you can change your mind about your coverage several times during the current open enrollment period, you can only make one change during the January-through-March window.

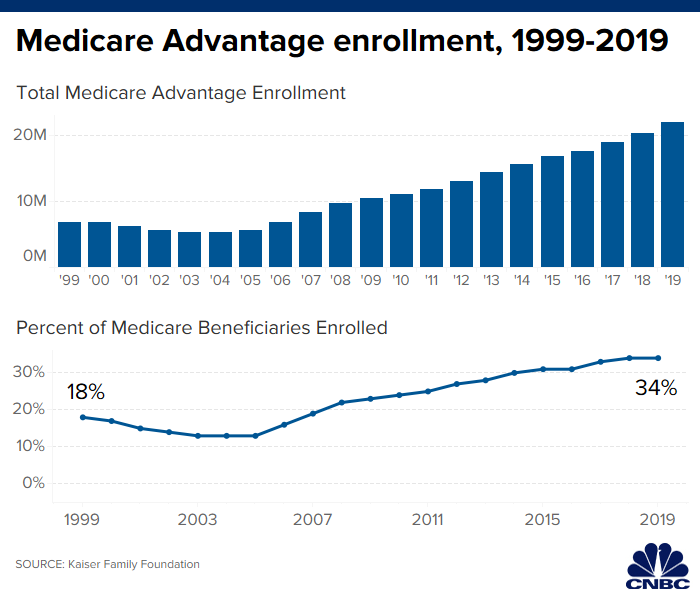

The average premiums for Advantage Plans is forecast to be $23 next year, down from close to $27 in 2019. Yet this year, 56% of enrollees paid no premium, according to the Kaiser Family Foundation.

Regardless of the amount, keep in mind that it’s in addition to your Part B premium. Although there’s been no official word yet on what that 2020 base amount will be, it’s projected to rise to $144.30 from $135.50 this year, according to the latest Medicare Trustees report. The deductible for Part A is forecast to increase to $1,420 from $1,364, and the deductible for Part B is projected to go to $197 from $185.

Weekly advice on managing your money

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

Additionally, monthly premiums for standalone prescription drug plans will be lower next year, dropping to $30 from $32.50 in 2019, according to estimates from the government.

To make sure your doctor, hospital or other provider still participates in your Advantage Plan, you have to check with the insurance company that offers it. You can either visit the provider’s website or call.

If you work with a Medicare agent, that person should be able to help you figure out what coverage is best for your personal situation. And, Gavino said, make sure the agent includes all plans available to you when evaluating your options — not just the policies they sell.

Also, be aware that open enrollment has nothing to do with Medigap policies, which can only be paired with original Medicare (not Advantage Plans). While there are some changes in the lineup of Medigap plans available to people turning 65 after this calendar year, they do not affect you if you reach that age before the end of 2019.