FatCamera | E+ | Getty Images

If you asked the IRS for six more months to work on your 2018 tax return, you’re about to run out of time.

This spring, about 15 million taxpayers asked the IRS for an extension on their 2018 tax return.

While those filers had to pay their projected taxes by April 15, they had to until Oct. 15 to complete and submit their returns.

Procrastinators take heed: If you miss this deadline, you’re on the hook for a 5% failure to file penalty.

Even with the extra time, accountants are still contending with last-minute filers and additional complexity from the Tax Cuts and Jobs Act, which went into effect in 2018.

“We are getting through extension season — a nightmare,” said Dan Herron, CPA and principal of Elemental Wealth Advisors in San Luis Obispo, California. “We have a long way to go in terms of understanding tax reform.”

Changes stemming from the new tax code include the elimination of personal exemptions and the near-doubling of the standard deduction.

Certain itemized deductions are now subject to new limitations, as well. For instance, the state and local tax deduction is now capped at $10,000.

Here’s what taxpayers should know if they’re about to hit that extension deadline.

A new tax break

UberImages | iStock | Getty Images

There are several reasons why filers sought more time.

For instance, investors in partnerships awaited Schedule K-1 forms from those businesses. These documents spell out the investor’s share of income from the partnership, and they often don’t arrive until late spring.

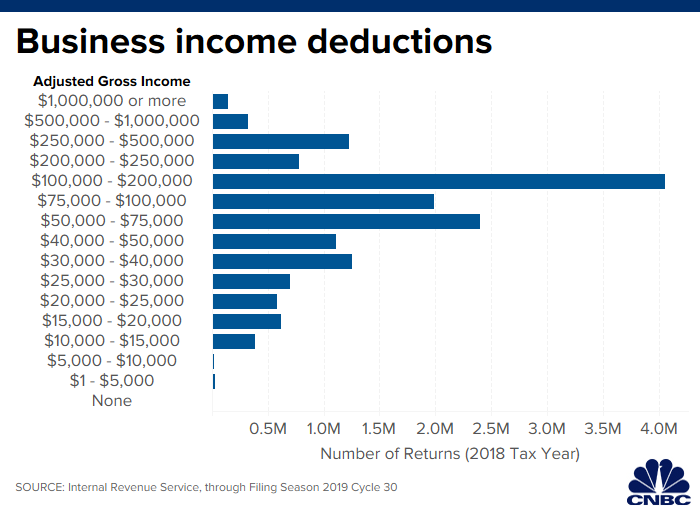

In addition, small-business owners — including the people who owned those partnerships — were trying to determine whether they qualified for the new 20% qualified business income deduction.

More than 15 million taxpayers took this deduction on their 2018 tax return as of July 25, the IRS found.

The rules around the so-called QBI deduction were still in flux for most of 2018 and part of 2019. This was a case where it was better to wait for certainty, accountants said.

“While we have an idea on a client’s situation as to whether they’re a trade or business, we were waiting until later for additional guidance,” said Chris Hesse, CPA and chair of the American Institute of CPAs’ tax executive committee.

“We think your risk goes down if we wait as long as possible to file,” he said.

Next year’s blueprint

It’s essentially too late for any 2018 tax-savings maneuvers, but you can still use that year’s return to shore up your year-end planning.

Consider buying equipment for your small business. If you’re an entrepreneur, you deduct the cost of property you buy for your business.

“If I have a good year in 2019, and I’m in the top tax bracket, I may as well buy the equipment now, get it placed in service and take a deduction for 2019,” Hesse said.

More from Personal Finance:

Not having long-term care insurance is the biggest devastator

Invest in your employer. Beware the risks

How families grapple with medical debt

Think about charitable giving. With the higher standard deduction of $12,000 for singles and $24,000 for married-filing-jointly, filers may need to donate aggressively to reach the threshold to itemize.

To do that you could bundle multiple years’ worth of charitable gifts into one year so you can get over the standard deduction.

Go over your tax withholding. If you owe more than expected, consider updating your Form W-4 — that’s the form that your employer uses to withhold the right amount of tax from your pay.

There are less than three months left in 2019, so you don’t have much time to get it right.