Stocks will try to regain their mojo next week as China and the U.S. hold long-awaited trade negotiations in Washington.

The Dow Jones Industrial Average dropped 0.9% this week while the S&P 500 slid about 0.3%. Overall, the two averages posted their first three-week losing streak since August.

Wall Street’s poor performance for the week comes after a disappointing U.S. manufacturing data report sparked fears of a recession. The report itself pointed to trade as a key source of weakness for the manufacturing sector, making next week’s trade talks the key focus for traders.

“Trade talks are crucial, not just for the U.S., but globally,” said Quincy Krosby, chief market strategist at Prudential Financial. “The conclusion from central bankers, CEOs and CFOs is we’re slowing down.”

“They are waiting for something constructive,” said Krosby.

The Institute for Supply Management said Tuesday that U.S. manufacturing activity contracted to its lowest level in more than 10 years. This data sparked a two-day sell-off in which the Dow dropped more than 800 points. ISM Chair Timothy Fiore said trade “remains the most significant issue.”

.1570219537741.jpeg)

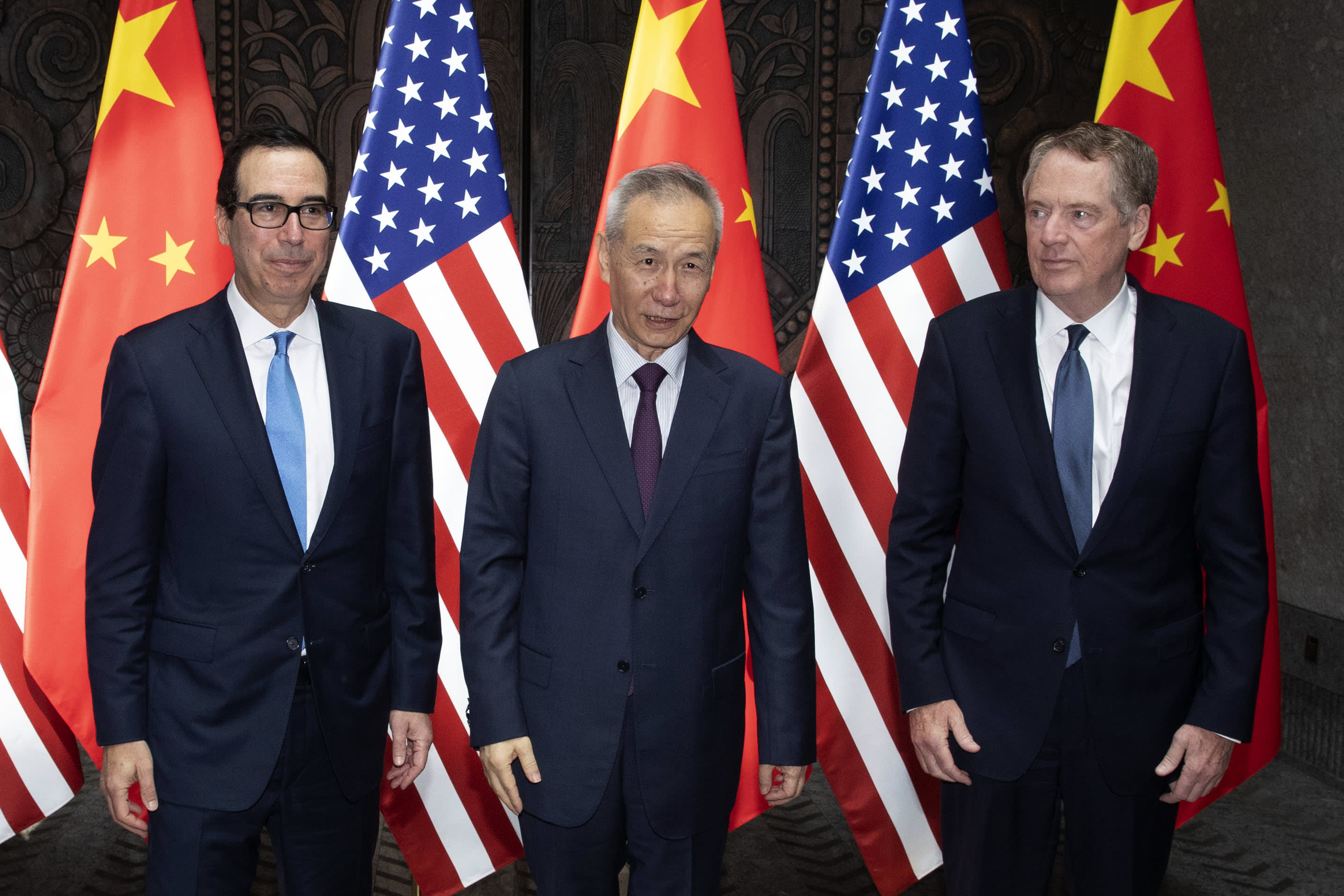

Trade tensions between China and the U.S. have heightened over the past year, with both countries exchanging tariffs on billions of dollars worth of their products. However, the tone around U.S.-China trade improved recently as China increased last month .

White House economic advisor Larry Kudlow also said Friday that “positive surprises” could come out of next week’s negotiations. Chinese and U.S. negotiators are expected to meet next Thursday and Friday.

But Peter Berezin, chief global strategist at BCA Research, warned signs of progress are crucial for the market moving forward. “Markets have entered a ‘show me’ phase,” he said in a note to clients.

Investors will also look ahead to the Federal Reserve releasing the minutes from its September meeting on Wednesday. The Fed cut rates last month by 25 basis points for the second time this year, citing “the implications of global developments for the economic outlook” among other factors.

Traders work on the floor at the New York Stock Exchange.

Brendan McDermid | Reuters

“It seems to me Powell is laying the blame or the explanation for the weakness directly at the feet of the administration,” said Jason Thomas, chief economist at AssetMark. “It’s growth outside of the U.S. It’s the parts of the U.S. economy that are exposed to trade that are being affected. Other than that, the economy is doing fine.”

Nonetheless, the probability of a third Fed rate cut increased this week amid weaker-than-forecast services and jobs-growth data. Market expectations for an October rate cut rose to around 80% from about 50% in the previous week, according to the CME Group’s FedWatch tool.

On Thursday, ISM said the U.S. services sector grew at its slowest pace since August 2016. Meanwhile, data released Friday by the Labor Department showed slower-than-expected jobs growth in the U.S.

Counterintuitively, the stock market got a boost after both data sets were released. The major averages posted solid gains on Thursday and rallied more than 1% on Friday with the Dow jumping more than 350 points.

“With job growth decent but slowing, a contraction in manufacturing, the ongoing trade war, and low inflation, the Federal Reserve will cut the fed funds rate” later in October, said Gus Faucher, chief economist at PNC, in a note.

Week ahead calendar (all times ET)

Monday

3 p.m. Consumer credit

Tuesday

6 a.m. NFIB Small Business index

8:30 a.m. Producer price index

Wednesday

10 a.m. Wholesale trade

10 a.m. JOLTS

2 p.m. FOMC minutes

Thursday

8:30 a.m. Weekly jobless claims

8:30 a.m. Consumer price index

Friday

8:30 a.m. Import prices

10 a.m. Consumer sentiment