Where are we to turn for high, safe dividends these days? Certainly not 10-Year Treasuries, unless you think you can scrape by on their 1.7% yields.

I’ll save you the calculation: you can’t, because that yield matches the inflation rate to the decimal point.

Your “true” income? $0.

The S&P 500 isn’t much better: for a pittance more (a 1.84% average yield), you’re exposing your nest egg to big drops.

But don’t, because I’ve got a better way—a low-key alternative I call a “layup dividend.” If you’re a basketball fan, you know what I’m talking about: the layup is the simplest shot in the game, where you simply “lay” the ball over the rim into the net.

I call these investments “layup dividends” because with just one click you can triple the S&P 500’s payout without putting your nest egg on the line. Best of all, these “layup dividends” are tax-free for most Americans!

(I’ll name four specific buys in just a moment.)

That turns, say, a 5% dividend from one of these “no-brainer” income plays into 8%! if you’re in the highest tax bracket. And now is a terrific time to buy them.

“Layup Dividends” Revealed

The investments I’m talking about are municipal bonds: debts issued by cities, states, counties and towns to fund badly needed infrastructure.

I can practically see your eyes glazing over, so I’ll get to the point: municipal bonds offer much higher dividends than Treasuries and stocks, especially if you buy them through a closed-end fund (CEF), my favorite approach.

Why CEFs?

For one, the municipal bond, or “muni,” market is tough for individuals to access. ETFs aren’t great, either, as the payouts just aren’t there: the iShares Muni Bond ETF (MUB) only yields 2.5% today.

When it comes to munis, then, we need a pro at the helm. And it helps if that pro comes from, say, Nuveen, an asset manager with $970 billion under management.

So you can bet that when towns and cities issue new bonds, Nuveen gets the first call. It’s an almost-unfair advantage for Christopher L. Drahn, CFA, manager of the Nuveen Quality Municipal Income Fund (NAD), the first of four muni funds I want to show you today.

NAD is one of the biggest muni-bond CEFs out there, with $5 billion in assets. Christopher has used his edge well, clobbering MUB over almost any timeline you can conjure up: one year, five years, 10 years—it’s almost too easy!

Keep in mind, too, that NAD’s return includes dividends, so it’s understated: your take-home would’ve been much higher thanks to the tax exemption. For example, if you’re in the top tax bracket in the US, NAD’s 4.5% yield could be worth as much as 7%, in real terms—and it’s paid monthly!

When you add it all up—(tax-free) dividends 2X (and more) Treasury rates, steady growth and monthly payouts—it’s a no-brainer which one to buy.

How We Tapped “Boring” Munis for a Low-Risk 32% Return

It gets better, because NAD is poised to hand us even more upside, thanks to its big discount to net asset value (NAV). That’s a quirk of CEFs that lets them trade at a price below the value of their portfolios.

For NAD, that discount is 10.7%, so you get its muni holdings for $0.89 on the dollar. That’s free money! And it sets you up for nice gains as that discount narrows, while giving you a downside “cushion” as you enjoy NAD’s tax-free payout.

Because the truth is, nothing can ignite a CEF’s price faster than a narrowing discount.

Consider NAD’s sister, the Nuveen AMT-Free Municipal Credit Income Fund (NVG), which I recommended in my Contrarian Income Report advisory in April 2016 (we’d held another muni fund, the Nuveen Municipal Opportunity Fund, since August 2015, until it was merged into NVG in early 2016).

At the time, NVG traded at a 9% discount as investors dumped their new shares to skip the effort of actually looking into the merger. What were they missing? A headline yield of 6% (also tax-free) that was above what NIO paid before it was melded with NVG!

“Buying the Dip” Pays Off With Muni CEFs

Today, NVG’s discount has closed to just 3.8%, and that vanishing discount has paced the shares higher: folks who followed my April 2016 buy call are sitting on a 32% total return, with much less volatility than the market.

What’s more, if you’d bought every time the discount widened since (in blue below), you’d have enjoyed a smooth ride to serious returns. Take a look:

Every time the discount widens and then snaps back, it takes the share price with it. It’s unmistakable.

Your Second Chance to Jump In

Today, NVG’s discount, at 3.8%, isn’t enough to excite us, so I’ve made it a hold in Contrarian Income Report—we’ll happily sit on our 32% return while pocketing our tax-free 6% dividends!

But if you still want to get into the muni game, consider NAD and its 10.6% discount. That markdown gets more compelling when you add in another muni-CEF “trigger” that just cropped up: the rebound in US Treasury rates.

Muni CEFs tend to move opposite bond yields, which is why they’ve taken off in 2019 as yields fell. But the rebound in the 10-year Treasury yield in the past month has given us a nice entry point as NAD pulled back in response.

And by the way, NAD is far from your only option: there are 140 muni-CEFs out there, at both the national and state level. But to get the best market access and top managerial talent, you’re best to stick with funds from the biggest players.

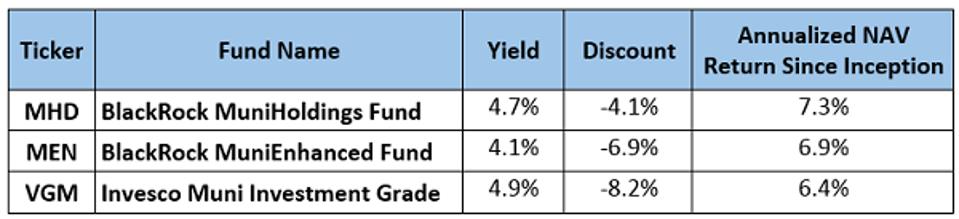

Here are three more to consider. Each trades at a discount, yields close to 5% and has returned at least 6% annualized on NAV since inception:

3 More Muni CEFs With Big Tax-Free Yields

Contrarian Outlook

Brett Owens is chief investment strategist for Contrarian Outlook. For more great income ideas, click here for his latest report How To Live Off $500,000 Forever: 9 Diversified Plays For 7%+ Income.

Disclosure: none