Plenty of parents start their kids off with a piggy bank to underscore the importance of savings. Very few teach their children how to invest.

“Investing is something a lot of parents struggle with,” said Roger Young, a senior financial planner at T. Rowe Price in Owings Mills, Maryland.

Parents who don’t have best habits themselves talk less about it with their kids and may pass on negative habits, he added.

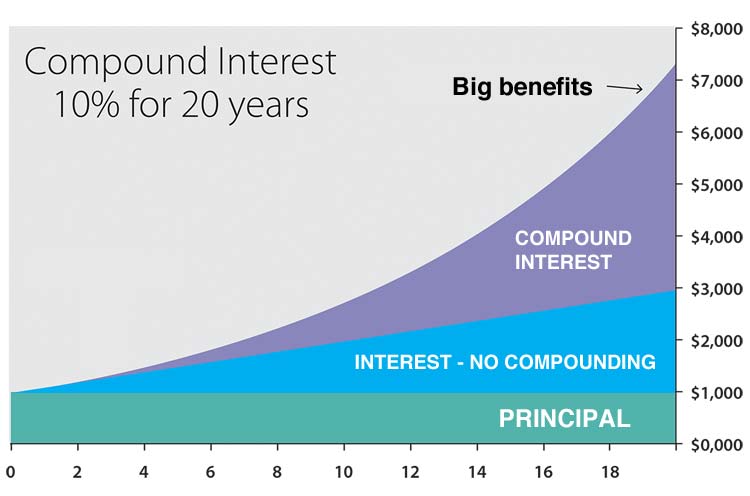

Of course, kids can simply set money aside and watch it grow, thanks to the magic of compound interest.

However, “it’s hard to meet long-term goals without investing,” Young said. “Certainly, it starts with saving, saving comes first. But in terms of long-term success, investing has to be the next step.”

“The interest we can get from bank accounts is very low so investing is a way to make your money go further,” he said.

For example, a 10-year old who stashed $1,000 in a high-yield savings account earning 2% would have close to $3,000 by retirement age. Alternatively, if they earned 7% a year by investing that money over the same time period, that deposit would grow to more than $41,000 by age 65. (See another example in the chart below using an above-average interest rate of 10%.)

Once kids understand interest, they can take on investing and the stock market. They’ll have the ability to earn even more if they can grasp a few key concepts, Young said.

- Stocks vs. bonds: When you invest in a stock, you are a partial owner of the company. Alternatively, when you buy a bond, you are lending money.

- Risk vs reward: If you take on more risk, the rewards tend to be greater over time. However, the likelihood of losing money increases as well.

- Time horizon: Saving for something six months down the road is different than saving for something five years from now when it comes to investing. While stocks may sink from time to time, over the long run they go up.

- Diversification: Investing in a few companies reduces the risk compared to investing in a single stock.

Parents can snag their child’s attention with examples they may particularly care about, Young advised, such as Apple, Amazon, Netflix or Nike.

More from Invest in You:

How to break up with your financial advisor

What’s your smart money IQ?

Here’s how to avoid some big money mistakes

“Explain that these companies need money to make their products, so sometimes they sell stock to raise money,” said Liz Frazier Peck, a certified financial planner and the author of “Beyond Piggy Banks and Lemonade Stands: How to Teach Young Kids About Finance.”

“If your child buys stock in a company, it means they own a piece of that company,” she said. “If the company does well, they make money and vice versa.”

A Uniform Gift to Minors Act (UGMA) account or a Uniform Transfer to Minors Act (UTMA) account is a great way to get started.

These custodial accounts let adults to transfer assets to minors without setting up a special trust.

The UGMA allows for bank deposits, stocks, bonds, mutual funds and insurance policies. The UTMA allows for all of that plus real estate. In 2019, individuals can deposit up to $15,000 and couples up to $30,000 without incurring federal gift tax.

In these cases, the assets belong to the child upon reaching the age of maturity (typically 18 or 21 depending on the state you live in) and your child will be able to use the funds as cash, a scenario that may not work for everyone.