Your bonds could get killed by rising rates. Here’s where to buy protection.

Inflation is tame. Interest rates are low. Perhaps they are destined to go still lower, even into the negative territory you see in Europe.

Perhaps not.

There is a small but palpable risk that, sometime in the next decade or two, the Federal Reserve’s inflation-tilting policy will work with a vengeance. We might get a replay of the rising rates and crashing bond prices seen in the 1970s. How do you protect yourself?

Yield Curves

Forbes

Presented here are seven ways to hedge against rising rates. You might want a hedge if you have fixed-income assets, such as bonds or a corporate pension. You also could use a hedge if you have floating-rate debt, such as an adjustable-rate mortgage or a bank loan to your business.

The methods range from easy to difficult, from tame to exotic.

#1. Shorten maturities.

Sell off funds holding long-maturity bonds and substitute funds with short-maturity bonds. ETFs from Schwab and State Street are tied for first place in our list of cost-efficient short-term government bond funds.

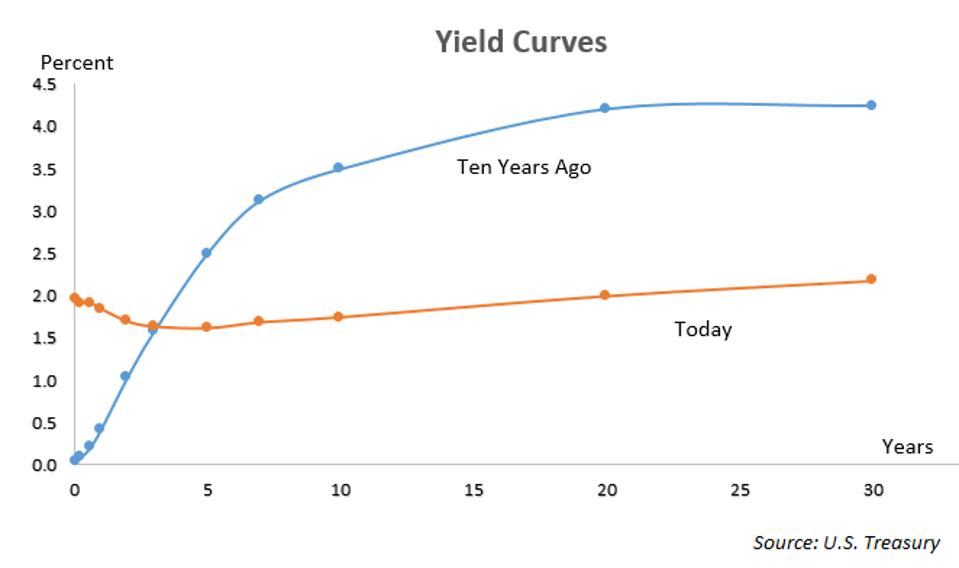

Pros: These funds offer low fees and high liquidity. You give up only a little yield now in shortening the maturity of your portfolio: The 1.7% yield on the two-year Treasury is only 0.05% less than the yield on the ten-year.

Con: Interest rates might continue to fall. Down the road, you might be reinvesting on worse terms.

#2. Buy TIPS.

Swap some of your conventional bonds for Treasury Inflation-Protected Securities. The exchange-traded fund from Schwab leads our scorecard of cost-efficient TIPS funds.

Pros: Good TIPS funds have low fees, and they’re easy to buy and sell.

Cons: This switch protects you from only one source of rate rises, namely, inflation. The other cause is an increase in real rates (nominal rate minus inflation). When that happens, the prices of TIPS will go down along with those of other bonds. At the moment, real yields have room to grow; they are not much better than half a percentage point at the long end of the yield curve.

#3. Buy a hedged bond fund.

A few funds holding corporate bonds use derivatives to hedge some or all of their rate risk. That leaves you with pure credit exposure. The iShares Interest Rate Hedged Corporate Bond ETF gets on the Forbes ETF Honor Roll for its combination of good liquidity and low effective holding cost.

Pro: You’d be well protected during a resurgence of inflation, since that would make borrowers less default-prone at the same time that the hedge lessens the damage from rising rates.

Con: Deflation would toast you on both sides: more defaults coupled with hedging losses.

#4. Buy an exotic ETF.

Two funds of note: ProShares UltraShort 20+ Year Treasury (ticker: TBT) and Quadratic Interest Rate Volatility & Inflation Hedge (IVOL). These funds do very different things.

TBT holds short positions in Treasury bonds. Over the past decade those bonds have been mostly going up in price, giving rise to an 18% annualized loss for the fund. But the fund does what it is supposed to do. During intervals of rising bond yields its price goes up.

IVOL blends a large position in inflation-protected Treasury bonds with a small stake in speculative yield-curve options. The options will pay off if the curve, now rather flat, resumes its usual upward tilt.

IVOL delivered a cumulative 3% return from its launch in May 2019 through mid-September. The entrepreneur behind it is the subject of a profile in the Sept. 30 issue of Forbes.

Pro: These funds enable small-fry investors to speculate on, or hedge against, a spike in inflation.

Con: They’re both expensive. IVOL’s 1% expense ratio is especially high in light of the fact that most of your money is invested in a TIPS position that you can get cheaply on your own.

#5. Buy a put on a bond fund.

The iShares 20+ Year Treasury Bond ETF (TLT) is a bullish bet on long bonds. Put options against it are a bearish bet—that is, a hedge against rising rates. When the fund was recently trading just below $142, a put option expiring Dec. 20 and exercisable at $140 was trading at an ask price of $3.10 on the Chicago Board Options Exchange.

A single 100-share contract would cost $310 plus commission and would be a bet against $14,200 of bonds. However, if you want your options to have the same rate sensitivity as $14,200 of long bonds, you need something closer to two option contracts, because options don’t move in lockstep with what’s underlying. Randy Frederick, a Schwab options expert, recommends using a limit order when you place the trade.

Pro: CBOE options are very accessible to small players.

Con: If this option expires out of the money, which is more likely than not, you lose the entire premium you paid for it.

#6. Sell a futures contract.

You could take a short position in the contract that calls for delivery, in December, of $130,000 of 10-year Treasury notes. If rates rise the notes fall in price and you make money.

This kind of derivative is not for beginners. The perplexing $130,000 price corresponds to $100,000 of imaginary T-notes with 6% coupons. The 10-year futures contract allows delivery of notes with maturities considerably shorter than 10 years, so you need complex calculations just to assess how the futures price responds to changes in yields. The price quotes are confusingly written in 32nds and 64ths; “129’295” on the Chicago Mercantile Exchange really means $129,922.

To hedge $1 million of medium-maturity fixed income assets you would go short 7 contracts, says Mike Zaremski, senior manager at Schwab Futures. Commission and fees on this trade would be only $16.

Pro: The CME contract is extremely liquid, with a daily volume in the neighborhood of $150 billion. Bid/ask spreads are much tighter than on the CBOE options in #5.

Con: If you don’t know what you’re doing you could get into deep trouble.

#7. Buy a futures option.

You could buy a put on the December note future of #6. One with a strike price of $130,000 was recently quoted at $1,156.

Pros: Your loss is limited to whatever you paid for the option; there’s no margin call. Spreads are fairly tight.

Con: as with #5, you can easily lose the entire option premium.

For further research:

Treasury’s yield curve archive