- CNBC’s Jim Cramer maps out what he’s expecting in stock news next week, including economic data from the U.S. and China, along with earnings reports.

- The “Mad Money” host is says Amazon and Campbell Soup are worth buying here.

- Cramer sits down with home decor retailer At Home CEO Lee Bird to hear how the company is managing the impact of tariffs on business.

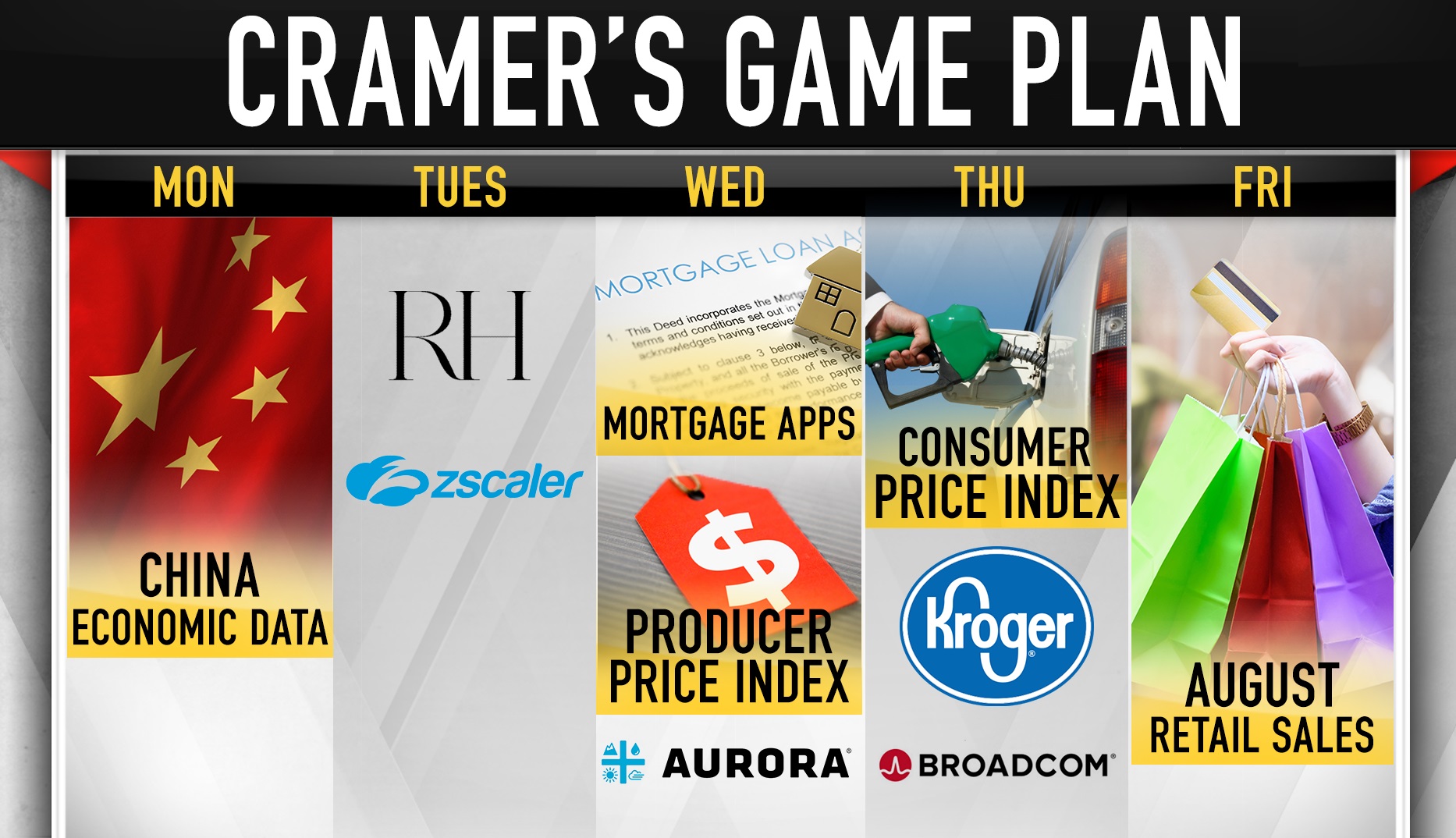

Cramer’s game plan

Cramer said Friday the Federal Reserve should cut the benchmark interest rate “aggressively” to help cushion the blow from the ongoing U.S.-China trade war.

“Even if the Fed chief won’t listen to the president, he should certainly listen to the bond market, which has made it crystal clear that he raised rates too fast and now they got to come down almost immediately,” the “Mad Money” host said.

U.S. Treasury bonds, with the exception of the 30-year bond, are all yielded less than 2% as of Friday.

Buy the dip in Amazon

Amazon CEO Jeff Bezos, founder of space venture Blue Origin and owner of The Washington Post, participates in an event hosted by the Air Force Association September 19, 2018 in National Harbor, Maryland.

Alex Wong | Getty Images

Amazon‘s stock may have put in a bottom and could be poised to break through the $2,000 price tag, Cramer said.

The host picked back up on the chart analysis from FibonnacciQueen.com’s Caroly Boroden, who in July forecast that equities of the e-commerce behemoth was on the verge of a bull run that would take the share price to new heights. The stock is down more than 4% since that late-July prediction.

Boroden thinks the stock is back in “uptrend mode,” Cramer said, and could have 20% upside in its future.

Campbell Soup “has become investible,” Cramer says

Cans of Campbell Soup Co. Campbell’s chicken noodle and tomato soup.

Andrew Harrer | Bloomberg | Getty Images

Despite Friday’s lower-than-expected jobs number and troubles in the bond market, Cramer told viewers now is not the time because there’s more money to be made in stocks. It’s the prime time to shift investments from cyclical names to slowdown stocks, he argued, whether investors believe a recession is upon us or just to diversify their portfolios.

Campbell Soup, which is the parent company of other household food brands like Pepperidge Farm, Goldfish and V8, is a defensive stock to own because it can work no matter what’s going on in the broader economy, Cramer said. Once a classic pantry play, the business attracted activist investor Dan Loeb of Third Point who wanted to turn things around at the company. The company has since brought in a new CEO in Mark Clouse, whom the host has thrown his support behind.

“With Campbell trading at 17 times next year’s earnings estimates and, still, 3.1% yield, I think the stock is a buy at these levels, and not just for speculation. This thing has become investible,” Cramer said. “And if they stumble? Hey, Dan Loeb’s standstill agreement ends in November, so he’ll soon be able to push for even more changes if they become necessary.”

Shares of Campbell are up more than 36% this year.

At Home CEO on stock price woes: ‘We think the stock is undervalued. It’s an opportunity’

Lee Bird, CEO, At Home

Scott Mlyn | CNBC

Shares of At Home, the home decor superstore, have struggled: down more than 60% in 2019 and nearly 80% in the past 12 months. The stock price rallied double digits in Friday’s session, but it’s down more than $33 from its all-time high back in July 2018.

That’s not stopping the confidence that CEO Lee Bird has in his company.

“We feel like we’re undervalued. We’re a high-growth retailer. We grew 19% last quarter. We continue to gain share. We’re profitable. And we’ve got a whole lot of white space in front of us,” he said.

“I’ve been buying at different times throughout the past three years and I still think it’s a great opportunity,” he added.

The company has been caught in the crosshairs of the U.S.-China trade war. Cramer asked Bird about his plan to dodge further escalation in the standoff between the world’s largest economies. The chief responded by saying “we’ve had a playbook. We’ve been working on this for a year now. We’ve had a lot of experience with it.”

Lululemon has the experiential factor that brick-and-mortar retailers need

Lululemon yoga class.

Source: Lululemon

Lululemon on Thursday reported a blowout quarter — earnings per share was 96 cents against an 89-cent analysts estimate and revenue was $883.35 million compared to an expected $846.83 million.

Cramer credited the results to the athleisure wear brand’s “experiential factor.”

“I mean real experiential. Not the kind of faux, all-talk experiential that everybody in the industry claims they have. Lulu’s got it, and they’ve got it for real,” Cramer said. “And that’s how you can put up 15% same-store sales growth, and it’s why their stock remains a buy, even though it’s already up more than 60% for the year.”

Cramer’s lightning round

In Cramer’s lightning round, the “Mad Money” host opined on caller questions about their favorite stock picks of the day.

: “Neogenomics is another one of these diagnostic companies that might have something that could work against cancer. I have yet to say no to any of those. I think that it is a good spec … because that is the holy grail.”

: “I am going to say: up 100% for the year, I am not going to push it here. I’m not.”

Disclosure: Cramer’s charitable trust owns shares of Amazon.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com