i

Getty

How often have you heard a value equity manager say his sector is overdone? Or have you ever heard a growth manager shout from the rooftops that growth stocks are overvalued? Probably not.

Well, as a bond manager I will break the rules and tell you municipal bonds issued by high tax states are overvalued. Grotesquely overvalued.

These nose bleed high municipal bond prices in California, New York, New Jersey, Oregon and Minnesota are literally erasing the tax advantages they were intended to create. Remember, high prices equal limbo low yields.

In fact, yields in the high tax states are so low that most investors in those states who invest in 1-10 years will be better off either investing in municipals out of their state of residence or investing in taxable corporate bonds.

A shocking example

If this admission doesn’t shock you, then consider this: Last week Contra Costa Community College District—a system of three colleges and two education centers in the San Francisco Bay area—went to market with a new issue. Their financials are fine due to the stable property tax base of the district. Their debt and pension liabilities were well-managed too.

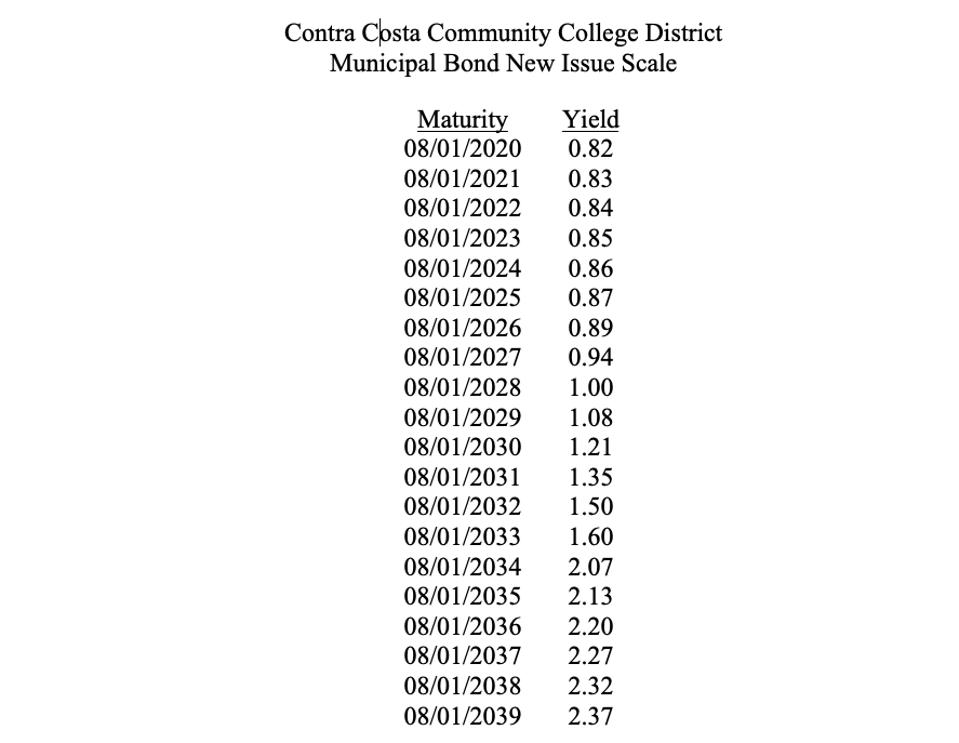

Here is the new issue scale, meaning the yield you’ll earn with each specific maturity.

What you see is correct. You’ll have to invest in bonds maturing in 2028 for a microscopic 1% tax free yield.

Go out of California and a comparable quality 2028 bond yields roughly 1.80%-1.85%.

As a California municipal bond investor myself, these chokingly low yields are unacceptable. If you reside in any one of the ten highest income tax states, you will quickly come to the same conclusion.

So what am I personally doing?

Just what you do-it-yourself investors should be doing—investing both in bonds outside our confiscatory states and in corporate bonds once I’ve calculated if the taxable equivalent yield generates more income than in-state municipal bonds.

And finally, tippey-toe into two or three leveraged closed-end national municipal bond funds with low fees. Place a maximum of 10%-15% of your municipal bond allocation into these closed-end funds. Bill Baldwin’s May 2, 2019 Forbes.com column, Closed-End Funds: Tax Exempt Bonds, has the names, numbers and tickers for you.

Those of you who have read my Forbes articles for decades already know I’m not a fan of bond funds. You’re not locked into the yield. But with low interest rates along with the cost of financing, allocating a portion of your bond portfolio to closed-end leveraged muni funds protects you if and when interest rates ever get back to an era of normalcy. We are clearly a long way from that time.

Corporate bonds

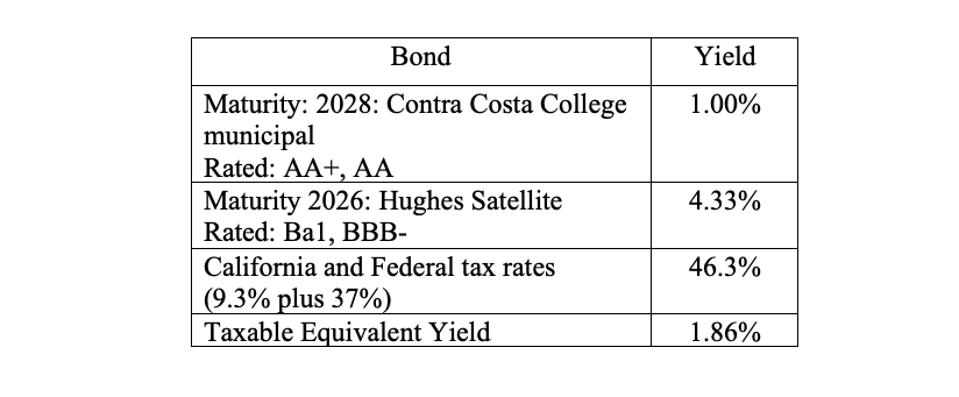

Here is a comparison of two corporate bond recommendations:

The Hughes Satellite bond wins hands down. Hughes (CUSIP: 444454AD4) 5.25% due August 1, 2026 is rated Ba1, BBB-. This wholly owned subsidiary of Echo Star is the largest broadband satellite network, secure communications (i.e. Military, secure communications, and broadband services to aircraft worldwide). Hughes is Echo Star’s largest revenue segment, representing 75% of all revenue. This bond yields 4.33% to maturity.

Now substitute a lower yielding, better quality corporate bond: Broadcom (CUSIP: 11134LAP4) 3.125% due January 15, 2025 rated Baa3, BBB-, BBB- yielding 3.35%. Under the same scenario an investor’s taxable yield of 3.35% is equivalent to a municipal bond yield of 1.80%, which would be at the end of 2033 on the Contra Costa College scale.

These calculations are easily found online at multiple sites. Just Google taxable equivalent municipal bond yields and the site will do the math for you. Investors refusing to pay the maximum state and Federal tax will continue seeing a stampede into munis causing prices to increase as yields plummet further. We are at 34 weeks of massive cash inflows into municipal bond funds. I am no keeper of such records, but this may be an all-time high or very close to one.

The genius of investing in municipal bonds is their Federal and sometimes state tax exemptions. Couple that with a lower default rate than corporate bonds. The European and Japanese Central banks and our own Federal Reserve with their Quantitative Easing black magic has changed the equation for many investors. I am one of them. Are you?