Generation X has had it rough financially. This group was heading into college as tuition began to skyrocket. They were pummelled by the tech bubble and great recession right when they started earning real money and owning assets that should be appreciating over time. While many people in Gen X are on track for financial freedom, many are facing an uphill battle to maintain their standard of living in retirement.

The younger members of Generation X are now in their forties. In contrast, the oldest members of Generation X are turning 56 this year. It is time for all members of Generation X to get serious about investing for retirement. Required Minimum Distributions (RMDs), Social Security, and Medicare will be here before you know it. I know this all too well, as a younger member of Gen X, who can hardly believe I am in my forties.

The Generation X Retirement Gap

In case you were wondering, Generation X, is the cohort of Americans born between 1965 and 1981. Many in this generation are approaching their peak earning years. At the same time, some of the older members of Generation X have likely already seen their earning peaks. As the Baby Boomer generation enters retirement, we are going to see what happens when people don’t save enough to maintain their standard of living in retirement. This realization may come too late for many people in Generation X.

The average 401(k) balance for someone aged 45-54 is just $115,000, according to Vanguard. According to the same study, the median 401(k) balance for the same group of Gen X workers is just $40,243. These numbers show two things. The “average” worker is in trouble when it comes to saving for retirement. From there, the median number shows that the situation is even worse than that. Let me ask you, how long could you live off of $115,000 or $40,000 for that matter?

The news is not all bad. For those willing to do the work (with the help of compounding interest and some smart money moves), there is still time to greatly improve your retirement nest egg. Keep reading to find out how.

Why Is Gen X So Far Behind Financially?

I’m not trying to single out Gen X. There are millions of Americans who are struggling to keep food on their tables and roofs over their heads. I also know many people out there would find a way to spend every penny they’ve earned, regardless of how much they make. (A prime example of this is all the pro athletes that go broke after making tens of millions of dollars). Additionally, many Gen Xers are the children of Baby Boomers, who are also in for a rude awakening when it comes to financial security in retirement.

Generation X has been raising kids while caring for their boomer parents. Many will find themselves sandwiched paying for college around the same time their parents (baby boomers, for the most part) are running out of money because they also didn’t save enough for retirement. Throw in the COVID pandemic, great recession, student debt crisis, keeping up with the Joneses and avocado toast, and you can see why so many people have little to nothing saved for retirement. Kidding about the avocado toast, people are poor because they drink Starbucks

SBUX

9 Ways Gen X Can Get on Track For Retirement

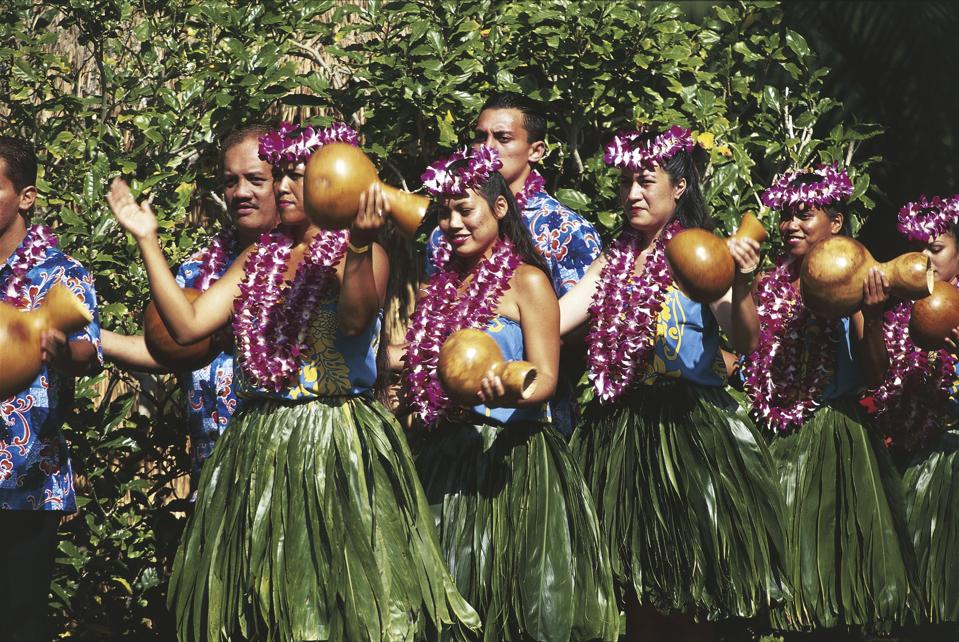

What does your dream retirement look like? Trips to hawaii? Hula (traditional Hawaiian dance) … [+]

De Agostini via Getty Images

1. Think About Your Ideal Retirement

When would you like to be able to stop working? Where would you like to live? How will you fill your days? Do you have amazing bucket list items you’d like to accomplish? Set goals for your ideal retirement (go bigger and set goals for your dream retirement), and begin taking the steps necessary to ensure you are on track for financial freedom. There is no one right answer to what retirement should look like. All the same, enough money can help make retirement more enjoyable.

2. Maximize Workplace Benefits

You should strive to maximize the tax benefits of your retirement accounts at work. For those lucky enough to have a generous employer match, you need to save at least enough into your 401(k) to get the entire match. Skipping the benefit could be a million-dollar mistake for the average worker.

Obtaining the maximum employer match is not enough. If you are starting early, you should be investing at least 10% of your salary into a retirement account. For those starting late, this number could be closer to 20% or even 30%. On the bright side, 401(k) contributions are made pre-tax, so you won’t feel all of this saving in your take-home pay.

3. Avoid Retirement Account Leakage At All Costs

A few years back, I spoke with someone who said 401(k) plans don’t work. They had been contributing the maximum for 20 years and only had $150,000 in their plan. I must point out this balance is above the average for their age, and the investment returns on their retirement funds had been great as well. However, they had taken loans and withdrawals several times from the account. Those early withdrawals resulted in large tax bills, as well as an additional 10% early withdrawal penalty each time a withdrawal was made.

Between the early withdrawal penalties and taxes, their retirement accounts would be worth millions less at the age of 70 than if they had left their retirement accounts alone.

4. Look For Ways to Save Money Without Cutting Back

If we are looking for silver linings in the COVID lockdown, one that comes to mind is we can get by on a lot less spending than we normally would. Take a hard look at where you spend your money and if any of that spending brings you joy.

I love to travel and spend a substantial part of my budget on this. Others may enjoy days at the spa, driving a nice car, or wearing designer clothing.

As you age (oh, how Generation X is aging…..), it is tempting to always be trading up to nicer things. This hedonistic treadmill may seem glamorous but can lead you to always be a few steps behind when it comes to a secure financial future.

Look for ways to save money without cutting back. One of my favorite examples was booking a trip to a Four Seasons resort when the fourth night was free. The total cost was 25% less than other guests, but we didn’t have to give up any luxury or amenities. In fact, the lower room cost allowed us to take an extra excursion. Other examples include paying for flights with airline miles or credit card points or two-for-one credit card vouchers.

Many have rediscovered the joy of cooking at home. Not only are you losing weight by eating healthier, but you also save a ton of money. Even brewing your morning coffee at home can really add up. This idea alone – the latte factor – led to a great bestselling book series called Automatic Millionaire.

Make smart trade-offs today that will help you avoid being forced to make unwanted trade-offs in retirement. Money can buy you time and options as far as where you live, how you fill your days, and whether you need to continue work or not.

5. Proactive Tax Planning

It isn’t how much you make but how much you keep. Being proactive with your tax planning can help you free up money to get your financial house in order. Lowering your tax liabilities can also help free up some money to invest in the future. It may even shave years off how long you have to work before reaching financial freedom.

I am writing this post in the midst of tax season, and every year I am amazed at how many people put zero thought into how to lower their taxes. The only time many people think about taxes is when they are filing their taxes. Missing valuable tax deductions or tax planning opportunities will leave many paying more in taxes than is necessary. Paying more in taxes means less money to invest in a dream retirement.

6. Refinance Your Mortgage / Rightsize Your Housing

There is a difference between being able to pay your mortgage and truly afford your mortgage (or rent). Many people are constantly struggling with being house-poor. Others end up going into debt every time something around the house needs to be fixed. My homeowners know there is always something that needs to be fixed.

Don’t wait until you are ready to retire to rightsize your house expense. One relatively easy way to do this is to refinance your mortgage. Rates are still near historic lows. Extending your mortgage (for example, getting a new 30-year mortgage) can help you lower your current monthly housing costs, which may be the difference between maxing out your retirement accounts and not contributing at all.

7. Save early, often, automatically, and aggressively

When I was 22, a good friend set me down and helped (aka forced) me set up a Roth IRA with a whopping $25 per month, automatic contribution. Saving automatically increases the chances that the money will actually get saved and invested. Now, I obviously save much more aggressively than I did at 22. I also make quite a bit more money these days.

Even if you have to start really small, get started. If you are already saving, increase that amount a little bit every few months. Mark your calendar every six months with INCREASE CONTRIBUTION TO INVESTMENT ACCOUNT (or 401(k), SEP IRA, Roth IRA, etc.). If you get a raise, put 50% (or more of that money) into investments. You won’t even miss the money.

8. Don’t rely on Social Security Alone

If your home and car are paid off, and you live extremely frugally, you may be able to live off Social Security alone. For the average American, Social Security will not allow you to maintain your standard of living in retirement. The average Social Security check is expected to be around $1,540, per month, in 2021.

9. Work With A Fiduciary Financial Planner

There are great financial planners out there who work will all types of people. Some will have assets minimum of say $250,000 /$500,000 or a million dollars or more. Some have no minimums at all. Ask your friends who they work with. Make sure whomever you choose, that person works as a fiduciary 100% of the time. You don’t want to just be sold some crappy producers so a stockbroker (calling themselves a financial advisor) can earn a big commission.

You may feel that you can’t afford to pay a financial planner what they are worth. I would argue many in Generation X cannot afford to not get professional guidance. The best financial planners out there provide massive value, far in excess of the fees they charge. According to Vanguard, the average financial advisor can add 3.75%, per year, to your investment returns over the long run. Imagine how much the best financial planners out there can improve your financial well being

At DRM Wealth Management, we provide the most value to our clients who are part of the LGBT community, small business owners, and/or have equity compensations (like stock options from companies like Google

GOOG

TSLA

AAPL

MSFT

Generation X, keep your heads up; there is still time to improve your retirement security. Look for ways to live a happier, healthier, and wealthier life today and in the future. Enjoy life, but get serious about planning for retirement; the day you stop working may be here sooner than you think.