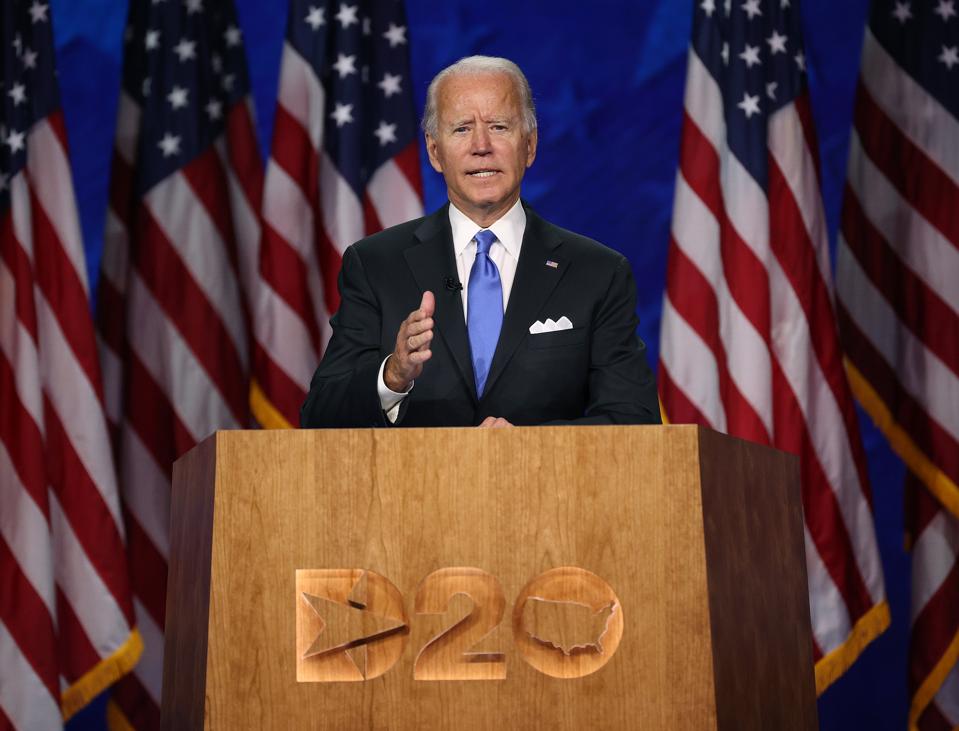

Oddsmakers’ favorite for the White House

Getty Images

Accelerate capital gains and bonuses. Defer deductions and buying a Tesla. Here’s what to do by year-end if a big tax law change looks imminent.

Per betting markets, it’s a 50-50 tossup whether the Democrats get both the White House and the Senate. If they do, taxes will be going up for prosperous people.

Deservedly so, you may think. But even if you are sympathetic to income redistribution as a matter of public policy, you would probably just as soon have someone else’s bank account get redistributed.

Here are tax changes that are either part of Joe Biden’s published proposals or that are plausible outcomes of a legislative committee groping for revenue:

• accelerate the demise of various Trump tax cuts from Jan. 1, 2026 (existing sunset date) to Jan. 1, 2021. This would take the top income tax bracket from 37% to 39.6%, kill the 20% deduction for pass-through business income, cut the standard deduction in half and cut the estate/gift tax exemption to $5.6 million or possibly down to $3.5 million.

• tax capital gains at ordinary-income rates, definitely for $1 million earners and maybe for everyone. Dividends would probably get the same treatment.

• eliminate the step-up that exempts unrealized capital gains at death. It’s unclear whether the heirs would owe tax immediately or instead be burdened with the original cost basis when they eventually sell. It’s likely but not certain that a bequest to a spouse will not be a taxable event, that there will be an exemption (maybe $1 million) and that there will be a ridiculous break for wealthy farmers.

• impose the 12.4% Social Security tax (combined employer and employee amount) on salaries above $400,000. This would leave—for now, but maybe not for long—a gap between $137,700 and $400,000 on which only the Medicare tax is levied.

• limit the value of deductions to 28%, even if the taxpayer is in a higher tax bracket than that.

• restore a kinky income tax surcharge that goes by the name Pease. If the 28% rule is implemented, you’ll get Peased 0.8%.

• eliminate the $10,000 ceiling on the deduction for state and local tax. This liberation is aimed at helping high-income people in blue states. However, the alternative minimum tax would limit the benefit they get from this deduction.

• restore the electric vehicle credit for brands that have exhausted their allotment.

• increase the corporate tax rate from 21% to 28% and make it harder for multinationals to duck the tax by parking profits offshore.

Not including state taxes, the effect of all this would be to kick up the highest marginal rates from 23.8% to 44.2% on long-term gains and dividends and from 40.8% to 56.6%, including the employer share of payroll tax, on employment income.

If you’re going from the standard deduction this year to itemized deductions in 2021, defer things like property tax to January.

It’s not too soon to plan your defensive moves. “Attorneys are going to be very busy at the end of the year,” says Pamela Lucina, chief fiduciary officer at Northern Trust Wealth Management in Chicago. “Get those trusts ready now.”

Here are nine strategies that you should be thinking about if the Dems sweep in:

Time gains and losses.

If you have appreciated stocks that you are likely to be selling in the next several years, you’d sell them now. If you do, postpone capital losses until January so you can use them against gains occurring in higher-tax years.

Accelerate a bonus.

Postpone deductions.

If you expect to use the standard deduction this year but go back to itemizing in 2021, it would make sense to defer donations and your year-end property tax until January. (Exception: Donate $300 this year, since the pandemic bailout allows nonitemizers to write off that amount in 2020.)

The accelerated bonus and capital gain would boost your 2020 state income tax, which you would cover with an increase in your January 15 estimated state payment; you would deduct that estimated payment on your 2021 federal return.

Postpone exit from tax shelters.

Cindy Ostrager, a CPA with Citizens Clarfeld Private Wealth, notes that suspended passive losses move onto your 1040 on complete liquidation of your stake. You probably want that event to take place next year, when losses will be more valuable.

Excercise options, maybe.

This is a wrestling match between the IRS and Black-Scholes.

Suppose you have a vested option with a strike of $30 on a stock trading at $31. If the option has five years to run, you’d be foolish to cash in now. That would net you $1 for a piece of paper that the classic option formula might value at $5 or $10. (See How Much Are Those Employee Options Worth?.)

But what if the strike were $5? Then the option’s value would be not much more than the $26 it yields from an immediate exercise. Taxes come into play.

Don’t procrastinate: “Attorneys are going to be very busy at the end of the year.”

If this is a qualified option, a.k.a. incentive stock option, the $26 is subject to alternative maximum tax. That ugly tax has mostly gone away under Trump but would come back to life under Biden. So you should exercise in December. Hold onto the shares for at least a year; if you sell before then or before two years from when you got the option you wind up with $26 of earned income, which would be undesirable if that windfall would get hit with payroll tax.

If this is not a qualified option, the $26 is considered earned income when you exercise. So, if your salary is over $400,000, it would make sense to exercise in December. Better to have that earned income hit this year than when it will be subject to the Biden payroll tax.

With the non-qual option, there’s no tax reason to hang on. Risk-averse employees sell the stock immediately.

Rothify, up to a point.

It has long been a good idea to think about converting some of your IRA to a Roth account. By paying taxes in advance you (and your heirs) get a totally tax-free investment. But it’s rarely a good idea to convert so much that you cross into a higher tax bracket, and it’s never a good idea to convert all of your retirement money.

The prospect of higher brackets in later years will probably increase the optimum sum for Roth conversion in December 2020. To get this right, buy your 2020 tax software as soon as the preliminary version comes out (probably around Thanksgiving) and fill in income estimates. Now do what-if games using different conversion amounts. See what converting $10,000 or $100,000 does to you. Pay particular attention to the state tax liability.

Proceed with caution. Conversions cannot be undone.

Look at your will.

If Biden kills step-up, your estate plan may be obsolete.

If you are leaving some money to relatives and some to charity, the will should already have flexibility built in. It should permit your heirs or executor to thrust assets with the worst tax liabilities onto the charities. Does it? It has to be carefully worded to interact in the right way with retirement accounts, whose beneficiary forms override will provisions.

Under either Trump or Biden, the taxable heirs would first take Roth IRAs, next, unappreciated assets, then appreciated assets, and then as a last choice taxable IRAs. Under Biden the third category is worth less and so maybe you need to adjust the dollar amounts of bequests.

Defer Tesla.

The credit is gone but might come back. Buy the car in 2021.

Review trusts.

Let’s say that, to minimize estate tax, you set up a grantor trust a while back and put $1 million of Amazon in it. Now it’s worth $2 million. You might want to sell the stock in December and buy it right back, says attorney Lucina.

Why? Well, you’d owe tax right now, let’s say $250,000. But you or your heirs are inevitably going to owe tax on the gain at some point. Better to be paying at Trump rates than Biden rates. Also, Lucina notes, the income tax payment shrinks your estate by $250,000, reducing estate tax.

Very wealthy clients aren’t waiting for the ballot counting. They are already funding trusts for kids and grandkids that use up their entire $11.6 million gift/estate/generation-skipping tax exemption.

What about opening a new GRAT, or grantor retained annuity trust? This particular tax dodge is so hard to justify that when Congress does it in it there may be no grandfather exemption. So I would be hesitant to spend several thousand dollars setting one up now in hopes that it will survive. Trust attorneys have a different view.

Get Forbes’ daily top headlines straight to your inbox for news on the world’s most important entrepreneurs and superstars, expert career advice, and success secrets.