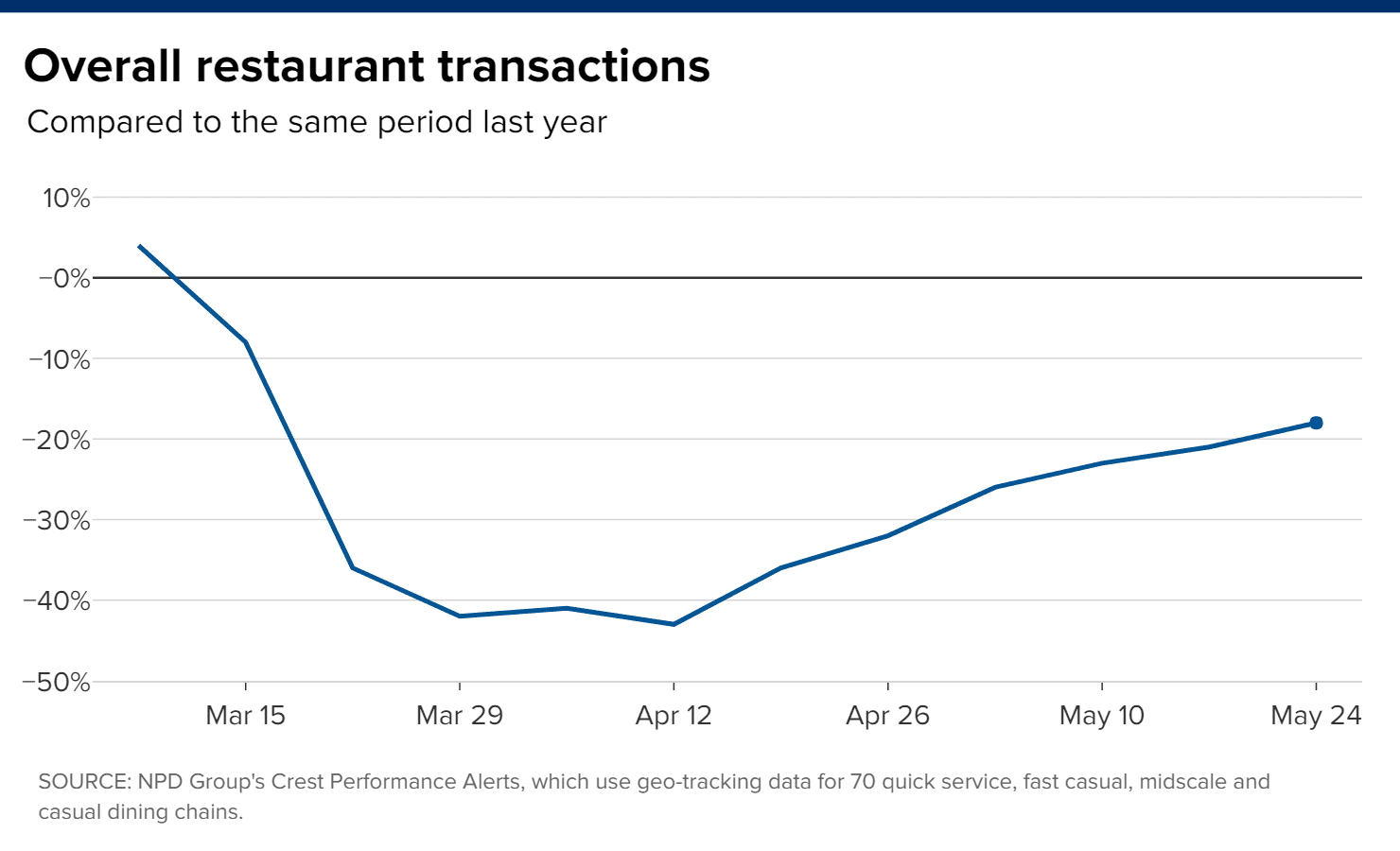

As states across the country reopen their economies, the restaurant industry is showing signs of recovery after stay-at-home orders and social distancing measures caused sales to crater.

The NPD Group, which tracks transactions for 70 quick-service, fast-casual and full-service restaurant chains, found that transactions declined just 18% during the week ended May 24.

Restaurant transactions hit their nadir during the week ended April 12. That Saturday, April 11, the IRS began depositing its first wave of stimulus checks in Americans’ bank accounts. The extra cash appears to have given the restaurant industry a boost as consumers who had grown tired of cooking looked to spend their $1,200.

By early May, some states, such as Georgia, began permitting dining rooms to reopen, despite concerns about a second wave of Covid-19 cases. The move further lifted restaurant sales, particularly for higher margin items like alcohol.

Now the NPD Group estimates that about 320,000 restaurants in the U.S. are allowed to offer some level of on-premise dining. But while many restaurants are permitted to reopen their dining rooms with limited capacity, some are moving more slowly, out of concern for their customers and employees.

With their deeper pockets, chains like those tracked by the NPD Group are more likely to have the resources to ride out the downturn to business. Independent restaurants, on the other hand, have a tougher road to recovery, with as many as 30% never expected to reopen their doors again.

Fast-food’s quick rebound

Fast-food establishments are the only restaurant segment that’s returning to pre-pandemic sales. Industry tracker Black Box Intelligence found that fast-food restaurants began seeing positive same-store sales growth in mid-May.

At its low point, transactions fell 41% during the week ended April 12. The convenience of drive-thru lanes, which typically accounted for about 70% of transactions before the crisis, likely helped the segment’s sales during lockdowns. And fast-food restaurants are known for their cheap deals, which might make them more appealing to consumers after the pandemic upended the U.S. economy.

But while the segment’s sales bounce back, traffic to fast-food restaurants remains under pressure, signalling that consumers are spending more during their infrequent visits to restaurants like McDonald’s and Yum Brands’ Taco Bell. Transactions fell 17% during the week ended May 24.

Full-service restaurants’ slower recovery

The pandemic hit full-service restaurants the hardest. Dining room closures forced many to pivot to delivery and takeout for the first time. Others chose to simply to keep their doors closed for the duration of the lockdown.

For three weeks in a row, at the end of March through mid-April, transactions at full-service restaurants plunged 79%. During the week ended May 3, the segment’s transactions fell less than 70% since states began rolling out stay-at-home orders.

Even as many governors allow customers to return to dining rooms with limited capacity, transactions at full-service restaurants are still down 42%, as of the week ended May 24.