Saving for retirement is hard enough without having to manage multiple investment accounts. With the proliferation of tax-advantaged accounts, however, many individuals juggle several if not more than a dozen retirement accounts. An investment tracking tool can help manage all of these accounts in one place, and below are the three best investment tracking apps that I use everyday.

getty

3 Types of Investment Management Tools

All portfolio management software can be divided into three types—linked accounts, manual entry, and spreadsheet based tools. Each has pros and cons.

With linked account apps, an investor can connect their investment accounts to the online tool. Information about all of the investments is then uploaded into the app, which then presents the user with data about their investments. These tools are the most convenient to use and offer bank-level security. Still, some may be reticent about providing login details to their investment accounts.

The second kind of online investment tracking tool requires manual entry of investment data. As such, these tools take a lot more effort to enter a portfolio and keep investment data updated. They do not, however, require the entry of account login information.

The final category is the use of a spreadsheet. While spreadsheets can’t provide the level of analysis that other types of investment tools provide, many prefer the control over the information that comes with a spreadsheet. And if one uses Google Sheets, as you’ll see below, Google finance functions can be used to pull in information about investments, including price.

Best Investment Tracking Apps

What follows are the three best investment management tools, one for each type listed above. I’ve used all three for many years.

Personal Capital

Personal Capital is by far and away my favorite investment tracker. If I could use just one tool, this would be the one. The app is free and can connect virtually all of your financial accounts—401(k), IRA, taxable investment accounts, bank accounts, credit cards, student loans and mortgages. It can even pull in the value of real estate using Zillow.

According to Personal Capital, data is encrypted with “AES-256 with multilayer key management, including rotating user-specific keys and salts.” And the website is “rated A+ by the world-renowned Qualys SSL Labs, a stronger rating than most major banks or brokerages.”

Once accounts are connected to Personal Capital, it provides a wealth of information. For investments, it aggregates data from all accounts into several dashboards, showing the value of each investment and its change from the last trading day. It breaks down a portfolio’s asset allocation and analyzes the fees charged by each mutual fund in the portfolio. It also tracks performance over time.

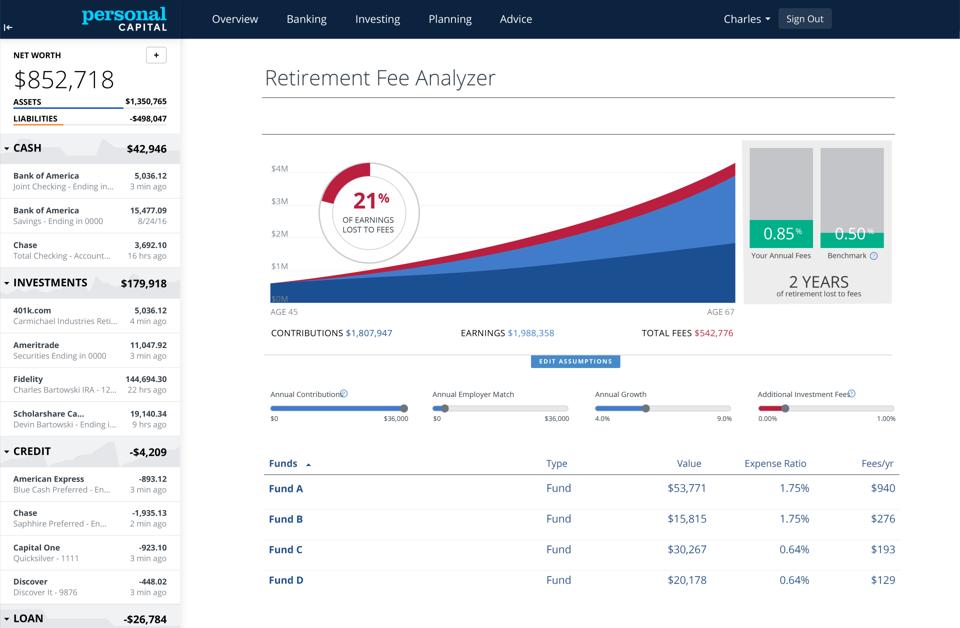

What sets Personal Capital apart from other tools is the analysis it provides. For example, it not only shows the fees of each mutual fund, it also analyzes those fees and displays the effect they will have on portfolio balances over time.

Personal Capital

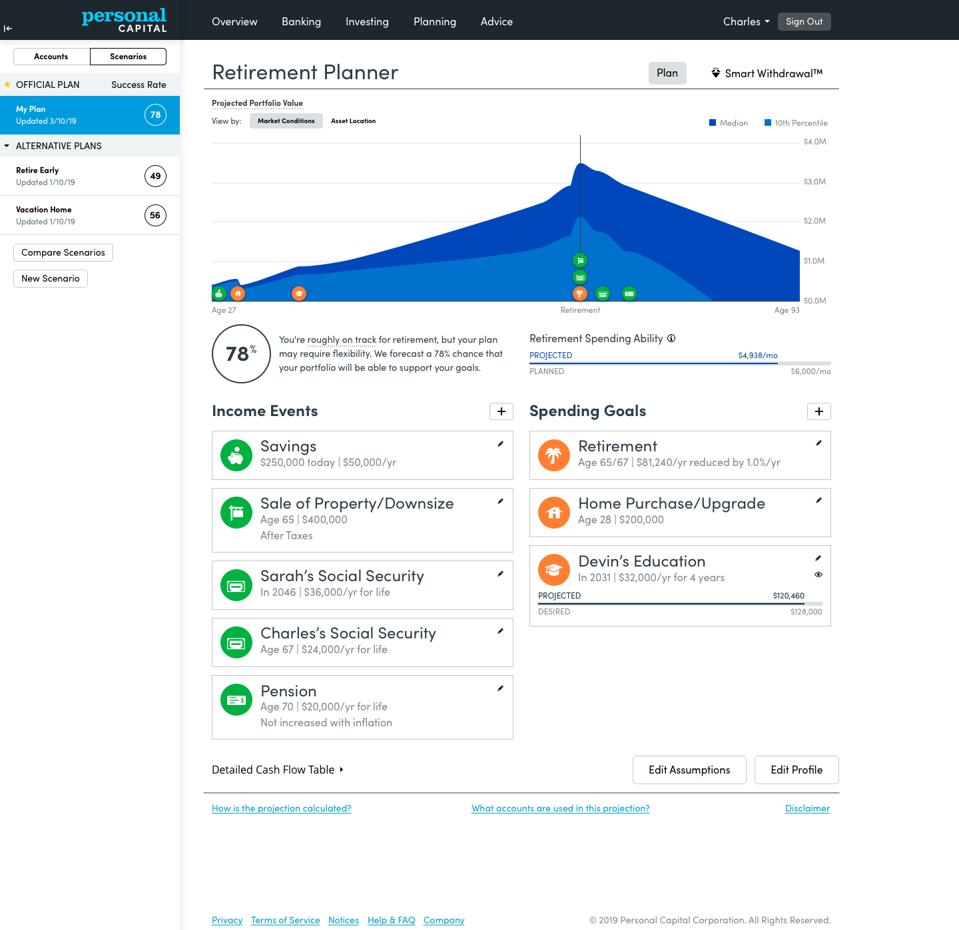

The same is true with its retirement planner. Personal Capital uses all of the linked accounts to help investors understand if they are on track for retirement. The Retirement Planner accounts for inflation, Social Security, and pensions. And a user can add one-time expenses such as a child’s wedding or a trip around the world. It even allows for multiple scenarios (e.g., retiring at different times, taking Social Security early), which a user can then compare.

Personal Capital

Finally, Personal Capital can manage all of an investor’s finances. Its cash flow tools track spending by category. These categories can be modified and new ones added. And Personal Capital captures all of this data in a number of charts and graphs, including its popular financial dashboard.

Morningstar

For those who would prefer to enter account data manually, Morningstar offers the most robust investment tracker. The tool provides a wealth of data about individual investments and the overall portfolio. It does, however, require a substantial amount of work to enter the data and keep it updated.

Once a portfolio is entered, Morningstar tracks an enormous amount of information, including:

- Portfolio performance over time

- Valuation and performance metrics, including PE Ratio, Return on Equity, and PEG Ratio

- Mutual fund fees

- Dividend growth

- Dividend yield

The wealth of information is the primary reason I use Morningstar in addition to Personal Capital. There is a learning curve to Morningstar, which is one reason I created a free video series on how to get the most out of the investment tool.

Morningstar offers both a free and premium account. The free account enables investors to track their portfolio. The premium account, which currently costs $199 a year, gives users access to additional information about their investments and portfolio.

Google Sheets

Finally, for those who want complete control over their data, a spreadsheet can offer a good solution. It won’t come with the data and analysis of the above tools, but it will provide enough information to manage even the most complex portfolios.

The best option here is Google Sheets. The reason is because we can take advantage of Google finance functions to pull in information about a stock, ETF or mutual fund. With just the ticker, you can pull in the name of the security, its current price, and for mutual funds, its expense ratio. You’ll find an example of an investment tracking spreadsheet here that you can copy and use.

I use a version of this spreadsheet to rebalance my portfolio. I find it easier than the automated tools above, even though they both provide data on asset allocation. With the spreadsheet, you can easily see how much must be rebalance by asset class. Note, however that the asset class is defined by investment. As such, it’s not ideal for those who invested in balanced funds, target date funds, or other mutual funds that cover multiple asset classes.

Final Thoughts

With countless tax advantaged accounts available today, it’s not unusual for an individual or couple to have multiple investment accounts. In our family, my wife and I both have multiple IRAs, 401(k)s, and HSAs. Add to that a taxable account, and managing the investments can become a nightmare. Each of the above tools, and perhaps even using all three, can make investment tracking a breeze.