For real estate, as for many things, 2020 was a strange year. Despite a pandemic, a recession and unemployment that at one time hit 20 million, 6 million homes were sold and the average home price was up 5 percent. There were record low mortgage rates of course, but there’s also the fact is that the recession has mainly been concentrated among people with lower-paid jobs – people who rent.

2021 will be a strange year too. With vaccines rolling out, we know the end of the pandemic is in sight, maybe by 2022? But that won’t mean any sort of return to normal, for the economy or for real estate. Here are a few things to consider.

1. Jobs: A lot of jobs are never coming back. Businesses have learned to work with fewer employees as the pandemic super-charged a trend already underway before the recession. Many of the lost jobs are in retail and at restaurants but high-paid computer engineers also are affected. Yes, the economy will eventually create other jobs, but that won’t help people in 2021.

2. Urban Migration: The movement to the big cities will continue. Even though the pandemic showed that many jobs can be done from anywhere, people and businesses still want to be near the infrastructure, the social activities, the access to premium healthcare.

3. Migration to More Affordable Housing: People will move where the jobs are, and away from expensive housing. For decades, young people moved from the Northeast to Texas and Florida. Recently they’ve been leaving California. With a lot of unemployment, a lot of people will be on the move.

These observations lead me to the following conclusions about real estate in 2021 and beyond.

In the short term there will be strong demand for more rentals, just when the supply has actually gone down. Unemployed renters will expand the lower end of the renter market this year but have financial difficulties. This produces more risk for investors in rental property; they should avoid the lower end and stay as close as possible to the center of the market which is what Local Market Monitor has identified as the rent range. After 2021 the lower-end market will again shrink. Remember that the average renter moves within two years; a lower-end property you buy in 2021 may well sit empty in 2022.

MORE FOR YOU

Photo by: STRF/STAR MAX/IPx 2020 12/22/20 Permanently closed businesses and retail stores are seen … [+]

STRF/STAR MAX/IPx

In the long term the market for rentals will continue to expand. The recession has again increased the number of people who can’t afford to buy a home. The surge of home buying in 2020 pushed homeownership to 67 percent, up from 65 percent in 2019, but that’s probably a one-time event; the recession damaged people’s savings as well as their income.

The fact that the surge in home buying only pushed home prices up 5 percent suggests very strongly that price increases in 2021 and 2022 will be modest. This will vary from market to market but there will be few opportunities for flipping properties in price booms. Rehabbing older ones for resale at higher values will be a much better strategy.

So, let’s identify the most promising markets for different kinds of investing.

Rehab Projects – 20 markets that are good prospects for rehabbing properties to higher values.

Local Market Monitor, Inc.

Table A shows 20 markets where prices were strong in 2020, as well as how much the actual average home price was higher than the income price, which is calculated from local income.

In real estate, the proof of the pudding is always in the eating; if home prices rose well this year, they’re very likely to rise well next year. So, these 20 markets are good prospects for rehabbing properties to higher values.

The home price to income price comparison shows how much risk comes with such projects. In markets like Boise, Tacoma, Phoenix and Tampa, where the home price is more than 25 percent higher than the income price, a boom is underway and investors should avoid multi-year projects.

On the other hand, in places like Memphis, Wichita or Rochester, there’s less chance that prices will fall but also smaller demand for expensive homes, so rehab projects there should have moderate goals.

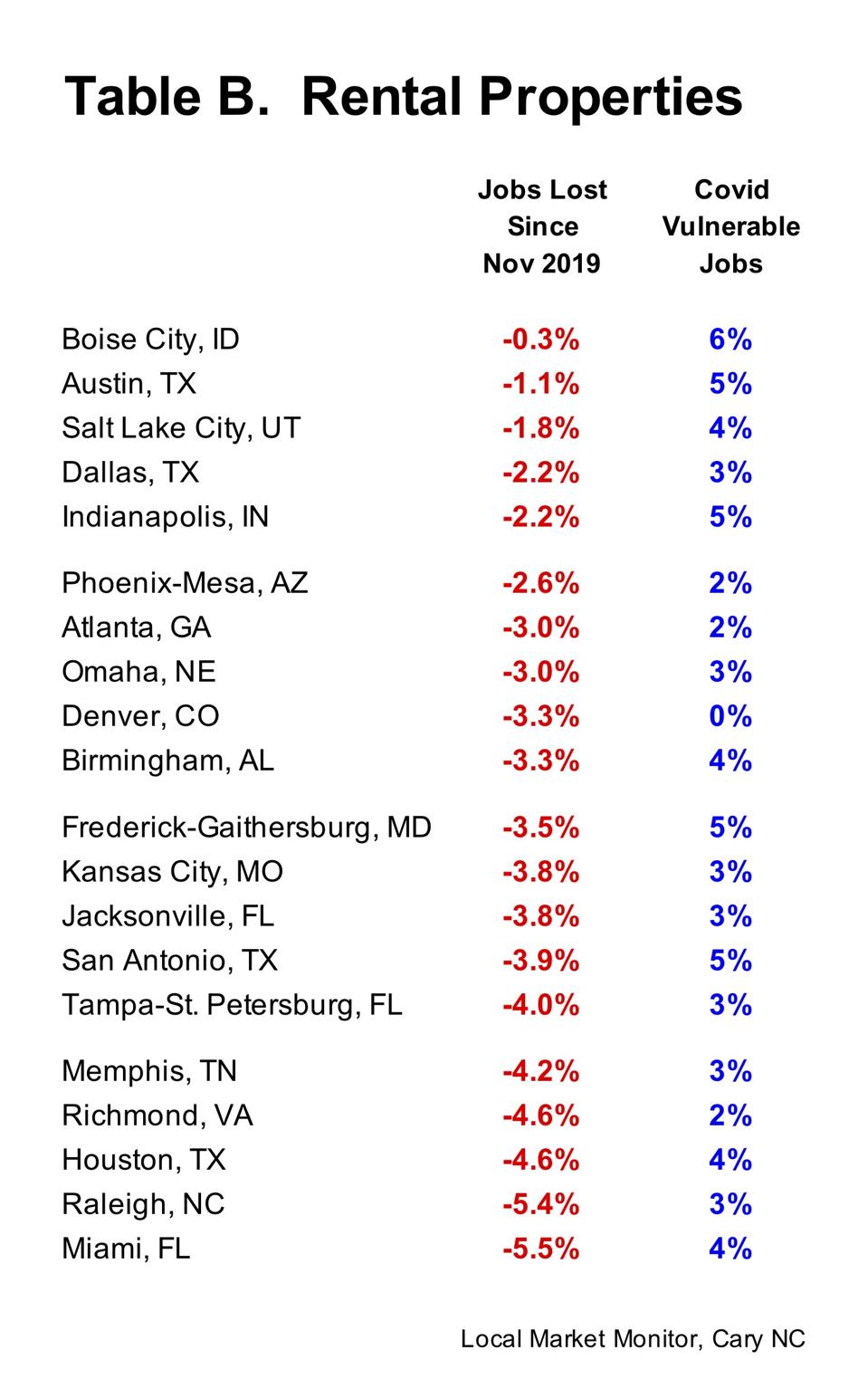

Rental Properties- 20 markets where the eventual loss of jobs is likely to be small.

Local Market Monitor, Inc.

Table B shows 20 markets where the eventual loss of jobs is likely to be small, because a lower proportion of jobs are in vulnerable categories such as retail, restaurants, tourism, healthcare and manufacturing.

By coupling the vulnerability of jobs (admittedly a speculative effort on my part) with the actual current job situation, we can identify markets that should be good long-term bets for investors in rental property.

The average US job loss in the past year was 6 percent, so a 2 or 3 percent loss right now looks pretty good. Because states have had different shut-down policies, the job numbers aren’t strictly comparable. Similarly, my estimate of how many jobs in each market are vulnerable is mainly relative (the average for 320 markets is 17 percent) and I don’t expect vulnerable jobs to necessarily become job losses.

Still, we know that jobs are the backbone of rentals; the statistics for these 20 markets suggest strong long-term demand from renters.

A few special remarks about the two lists. First, they include just one market from California, which has become so expensive that more people are leaving the state than entering; many of them moving to Boise, Phoenix or Salt Lake City. Second, a lot of these markets are in the center of the country; not so long ago Kansas City, Memphis and Indianapolis were not great investment spots. And third, although by some metrics Boise is the hottest market in the country, remember that the risk of investing there is also growing. Nothing is free.

It will be an interesting year for investors, with short-term disruptions and long-term consequences. It’s a time to really use your analytical skills.