Getty

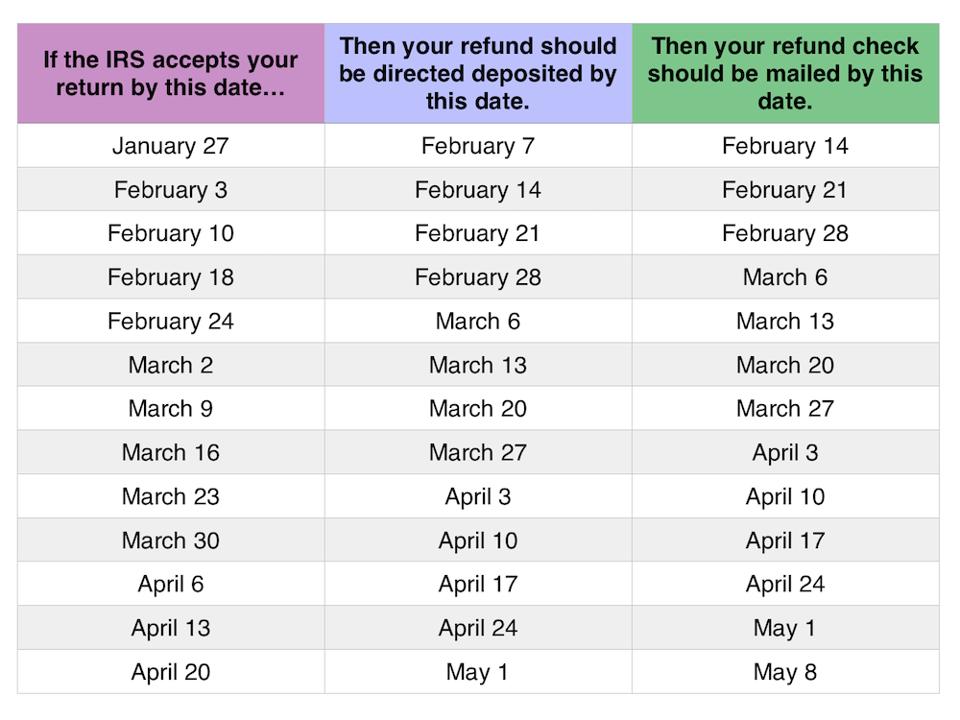

The Internal Revenue Service (IRS) has announced that tax season will open on Monday, January 27, 2020. And I know what you’re thinking: when are those tax refunds coming? Assuming no delays, here are my best guesses for expected tax refunds based on filing dates and information from the IRS:

Refund chart 2020

* No matter when you filed your tax return, if you claimed the EITC or the ACTC, don’t forget to take into consideration the required hold. Keep reading for more.

I can’t stress enough that these are educated guesses. I like math and charts as much as the next tax geek, but many factors could affect your tax refund.

My numbers are based on an expected IRS receipt date beginning on the open of tax season, January 27, 2020, through the close of tax season on April 15, 2020. To keep the chart manageable, I’ve assumed the IRS accepted your e-filed tax return on the first business day of the week; that’s usually a Monday, but if there’s a holiday (like President’s Day), I’ve skipped ahead until Tuesday.

I’ve typically assumed that the IRS will issue your direct deposit refund within 10-14 days of accepting your return, and will issue paper checks the following Friday. In reality, the IRS issues tax refunds on every business day, so the date could move forward or backward depending on the day your return was received.

The IRS officially says that it issues 90% 0f refunds within 21 days. Anecdotally, taxpayers with fairly straightforward returns and no flags or other issues receive their tax refunds in an average of 10-14 days.

Other sites may have different numbers, but remember they’re also just guessing since the IRS no longer makes their tax refund processing chart public. Do not rely on any tax refund chart—mine included—for date-specific planning like a large purchase or a paying back a loan.

Remember that if you claim the earned-income tax credit (EITC) and the additional child tax credit (ACTC), the IRS must wait until mid-February to begin issuing refunds to taxpayers who claim the EITC or the ACTC. In addition to regular processing times for banks, factoring in weekends, and the President’s Day holiday, the earliest EITC and ACTC-related refunds are expected to be available on or about February 28, 2020; that’s assuming direct deposit and no other issues.

If you want to get your tax refund as fast as possible, the IRS recommends that you e-file your tax return and use direct deposit. Keep in mind that if you e-file, the day that the IRS accepts your return may not be the day that you hit send or give the green light to your preparer. Check your e-filing confirmation for the actual date that the IRS accepts your return.

If you file by paper, it will take longer. Processing times can take up to four weeks since the IRS has to manually input data into the IRS systems. Don’t forget about postal holidays, too, when counting on the mail. There’s just one official postal holiday during tax season, Monday, February 17 (President’s Day), and one that follows just after tax season, Monday, May 25 (Memorial Day).

Even if you request direct deposit, you may still receive a paper check. Since 2014, the IRS has limited the number of refunds that can be deposited into a single account or applied to a prepaid debit card to three. Taxpayers who exceed the limit will instead receive a paper check. Additionally, the IRS will only issue a refund by direct deposit into an account in your own name, your spouse’s name or both if it’s a joint account. If there’s an issue with the account, the IRS will send a paper check.

If you’re looking for more information about the timing of your tax refund, don’t reach out to your tax professional. Instead, the IRS encourages you to use the “Get Refund Status” tool. Have your Social security number or ITIN, filing status and exact refund amount handy. Refund updates should appear 24 hours after your e-filing has been accepted or four weeks after you mailed your paper return. The IRS updates the site once per day, usually overnight, so there’s no need to check more than once during the day.

If you’re looking for tax information on the go, you can check your refund status with IRS2Go, the official mobile app of the IRS. The app includes a tax refund status tracker.