By Richard Eisenberg, Next Avenue Editor

The Washington Post via Getty Images

Unquestionably, there are plenty of urgent issues in the 2020 presidential election. But there’s one less urgent, yet equally critical one, that hasn’t received much attention: Social Security trust fund to pay retirement benefits is due to be depleted by 2035, perhaps even sooner due to the pandemic. The Congressional Budget Office sets the date as 2031.

What would President Donald Trump and Vice President Joe Biden do about it? (To be clear, trust fund insolvency wouldn’t mean Social Security wouldn’t pay any benefits starting in 2035; just that it would only have money to pay 79% of scheduled benefits at that time.)

We don’t know much about the answer to the Social Security solvency question for the president, because he hasn’t released specific Social Security reform plans. Biden has laid out a series of Social Security proposals, ranging from payroll tax increases on Americans earning over $400,000 to increased benefits for low-income retirees, widows and widowers, and the oldest Americans.

A Nonpartisan Think Tank Analyzes Biden’s Social Security Plans

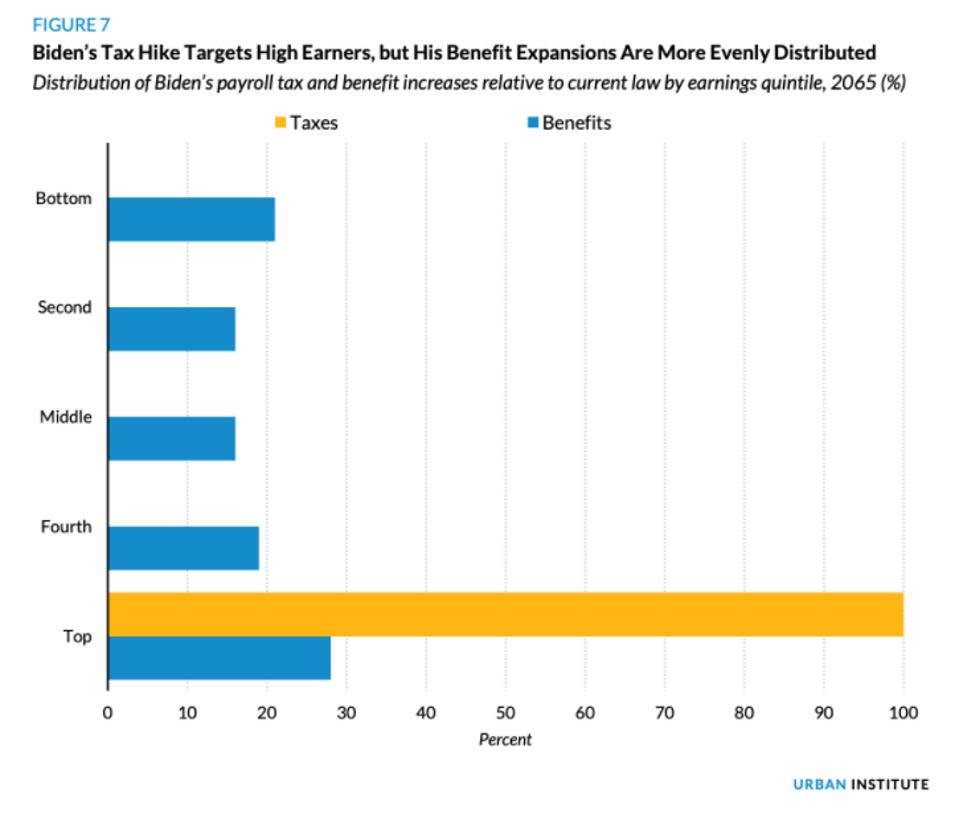

The nonpartisan Urban Institute think tank just analyzed what Biden’s plans would mean for Social Security. Its conclusion: if enacted, they would “close about a quarter of Social Security’s long-term financial shortfall.” And, the researchers say, “Social Security would still run a deficit every year under [Biden’s] plan, but not as much as it would under current law.” Bottom line: “His plan would extend the life of the program’s trust funds by five years, to 2040.”

The Urban Institute report notes that Biden would use some of the extra payroll tax revenue to increase Social Security benefits for some Americans.

I’ll explain how the authors of the Urban Institute report (Karen E. Smith, Richard W. Johnson and Melissa M. Favreault), “How Would Joe Biden Reform Social Security and Supplemental Security Income?” came to that view shortly.

The public is, unsurprisingly, divided about their confidence in the future of Social Security depending on who’s elected, based on a September 2020 poll by Simplywise.com, a digital retirement planning company. Even more so among Americans 60+ with political party affiliations.

SimplyWise found that 63% of Americans overall said they feel confident in the future of Social Security if Biden is elected, compared to 44% who do if Trump is re-elected. But just 11% of Democrats 60+ feel confident in Social Security’s future under a second Trump term; 95% of them feel that way if Biden wins. Conversely, 81% of Republicans who are 60+ feel confident about Social Security if Trump wins vs. 13% if Biden wins.

In the October 2020 Wells Fargo Retirement study, 72% of workers surveyed said they are afraid Social Security won’t be available when they retire and just 45% said they were optimistic that Congress will make changes to secure the future of Social Security.

What President Trump Told AARP About Social Security

When AARP recently asked the presidential candidates how they will ensure Social Security benefits won’t be cut, President Trump said: “We’ll never cut Social Security, and you can rely on that…We will guard it with everything we have.”

He has signed an executive order suspending through Dec. 31 for employees earning $100,000 and less the payroll taxes which fund Social Security. That was done to raise their incomes during the pandemic and help combat the recession. Trump plans to restore the lost payroll taxes with money from the government’s general revenue fund.

As Next Avenue’s Chris Farrell wrote, Treasury Secretary Stephen Mnuchin (the head Social Security Trustee) told Fox News that in a second Trump term, the administration planned to pay for Social Security by moving money “from the general fund to those trust funds.” Trump advisers have said the president has no intention of eliminating Social Security payroll taxes.

Urban Institute

Biden’s Plans for Social Security Taxes and Benefits

Here’s why the Urban Institute estimates that Biden’s Social Security reforms would reduce — but not eliminate — the trust fund’s long-term deficit:

The solvency shrinkage would come from Biden’s payroll tax plan. Currently, workers and employers split paying the 12.4% tax on earnings up to $137,700 (Starting in January 2021, the maximum earnings subject to the payroll tax will rise to $142,800.) Biden wouldn’t change the threshold but would tax earnings over $400,000, which — the Urban Institute says — would boost Social Security revenue 7% in 2021 and 12% in 2040.

Just 1% of workers would earn enough in 2021 to pay any of Biden’s proposed additional Social Security payroll tax, the researchers say, though that percentage would edge up over time, as more Americans would earn over $400,00 due to wage increases.

The Urban Institute report notes that Biden would use some of the extra payroll tax revenue to increase Social Security benefits for some Americans, reducing the amount the tax would otherwise have closed Social Security’s impending deficit. He’d replace Social Security’s minimum benefit with a higher one ($15,950 in 2020) for new beneficiaries and index that figure to the average national wage, so it would automatically rise annually.

Biden would also change the way Social Security calculates cost-of-living adjustments (COLA) to benefits, tying them to changes in what’s known as the consumer price index for the elderly. That index typically rises faster than the current COLA index. So, according to Social Security actuaries, it would increase COLAs 0.2 percentage points a year.

Other Biden proposals for Social Security include: giving Social Security earnings credits to workers who earn less than the average U.S. wage (roughly $50,000) and care for children under 12 and family members with disabilities; higher benefits for certain widowed Social Security beneficiaries; a bonus of 5% of the average benefit to Social Security beneficiaries who’d collected payments for 20 years.

The Urban Institute’s bottom line on Biden’s proposals: “Future tax increases or benefit cuts would likely be needed to balance the program.”

My bottom line: That would be true if President Trump is re-elected, too, based on what we know about his plans for Social Security.