MoMo Productions | Taxi | Getty Images

Forget rent. Cash-strapped millennials who are starting families have a new cost on the horizon: child care.

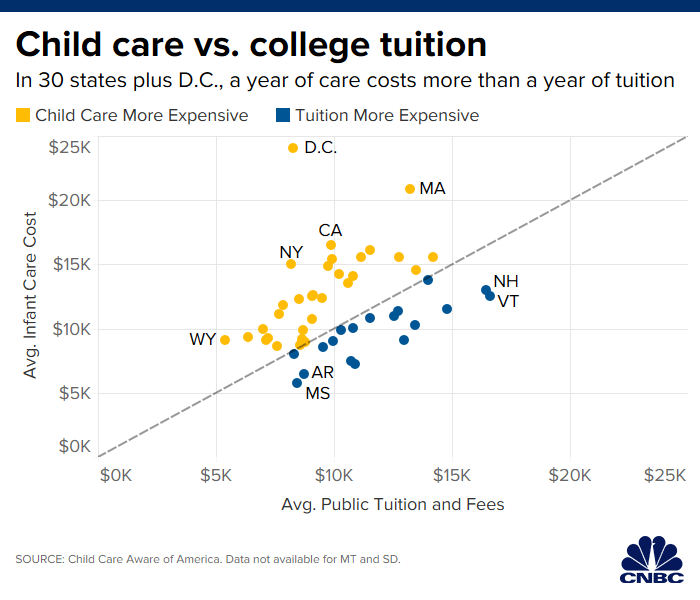

In 30 states and Washington, D.C., the annual cost of sending an infant to a child care center exceeds the annual in-state tuition and fees at a public college, according to new data from Child Care Aware of America.

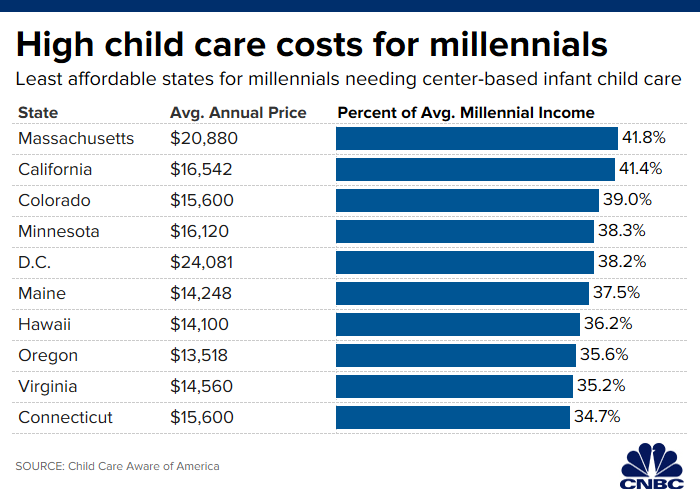

Massachusetts residents face some of the steepest expenses, relative to the amount millennials earn.

There the annual spend on center-based care for an infant has hit $20,880 — equal to nearly 42% of the average millennial’s income in the Bay State, Child Care Aware found.

In comparison, full-time undergraduates at the University of Massachusetts Amherst pay $16,389 in tuition and fees for the 2019-2020 school year if they are in-state students.

“The most significant message we’re sharing in this report is that child care is unaffordable across the U.S., and it’s often a significant burden for parents,” said Lynette Fraga, Ph.D., executive director of Child Care Aware of America.

California follows in second place, with an annual average price tag of $16,542 for infant care at a center.That’s equal to just over 41% of the average millennial’s income in that state.

Finally, Colorado rounds out the top three, with infant care in a center costing an average of $15,600 — or close to 40% of the average millennial’s pay, according to Child Care Aware.

Costlier than college

Millennials with young children are feeling the crunch because they’re often already facing daunting student loan bills.

Graduates in 2018 owed an average of $29,200, according to the Institute for College Access & Success. That’s up from $28,650 in 2017.

Rent costs are also devouring their earnings, particularly in coastal cities.

For instance, consider that in Los Angeles, the median rent is $2,095 — that’s equal to 45% of the $55,820 average salary, according to data from Zillow and the U.S. Bureau of Labor Statistics.

Savings opportunities

Hero Images | Hero Images | Getty Images

Families have some tools at their disposal to help them defray the cost.

For instance, some employers provide their workers with a dependent care flexible spending account.

This account allows workers to put away up to $5,000 each year per household on a pretax basis. If your child is under age 13, you can put the money toward daycare and before- or after-school care expenses.

There is a catch of course: You must use all the money in the dependent care FSA by the end of the year or else you forfeit the cash.

Another tool for working families is the child and dependent care care tax credit.

Based on your adjusted gross income, you can claim up to $1,050 for one child under age 13 or $2,100 for two or more kids under 13.

You’ll need the taxpayer identification number of the care center or the individual who is looking after your child in roder to claim it.

More from Personal Finance:

Your credit card debt could be making you sick

The 10 best places to vacation on a budget

Fisher Investments withdrawals exceed $2 billion

That means if you’re working with a nanny, your arrangement must pass muster with the IRS. You can’t pay this individual under the table and then claim the tax credit.

Instead, your nanny must be on the books. If you paid the person caring for your child — or any other household employee — more than $2,100 in 2019, you’re responsible for withholding Medicare and Social Security taxes, which add up to 15.3% of wages and are shared by the worker and employer.

Also, you can take the dependent care FSA or the tax credit, but you can’t use both to cover the same costs.